Market Profile: Triple Quadrupole GC–MS

Until recently, triple-quadrupole gas chromatography–mass spectrometry (GC–MS) has been a relatively obscure segment of the GC–MS market. However, it is now exploding into a major market segment. New entrants and recent instrument introductions indicate that there has been a significant unmet need in the GC–MS market for such capabilities.

Until recently, triple-quadrupole gas chromatography–mass spectrometry (GC–MS) has been a relatively obscure segment of the GC–MS market. However, it is now exploding into a major market segment. New entrants and recent instrument introductions indicate that there has been a significant unmet need in the GC–MS market for such capabilities.

While GC–MS is advantageous for analyzing compounds that are fairly volatile, having to perform quantitative applications with it generally required single ion monitoring methods on single-quadrupole machines. Selected reaction monitoring, sometimes referred to as multiple reaction monitoring, is more accurate for quantitation, but requires the MS-MS capabilities of tandem-quadrupole systems, which has led laboratories to adopt LC–MS-MS techniques instead.

One of the first widely commercialized triple-quadrupole GC–MS systems came from Waters in 2002, and was based upon the company's triple-quadrupole LC–MS system. Varian also entered the triple-quadrupole GC–MS market in 2002 with a system that could be configured either as a single or triple quadrupole, and used as either an LC–MS or GC–MS system. More recently, Thermo Scientific entered the fray by way of adapting its triple-quadrupole LC–MS system for GC–MS. Agilent's introduction of a triple-quadrupole GC–MS system at the end of 2008 that was designed from the ground up for GC–MS, rather than adapted from an LC–MS design, also had an impact.

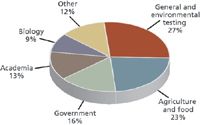

The market for triple-quadrupole GC–MS has grown from less than $15 million in 2007 to more than $40 million in 2009, despite the global recession. As food, environmental, and many biological laboratories adopt triple-quadrupole GC–MS for quantitative applications, annual growth in demand should remain well into the double-digits for a number of years to come.

The foregoing data were based upon SDi's market analysis and perspectives report: Global Assessment Report, 10.5th Edition: The Laboratory Life Science and Analytical Instrument Industry, August 2009. For more information, contact Stuart Press, Vice President – Strategic Analysis, Strategic Directions International, Inc., www.strategic-directions.com.

Market Profile: Mass, Molecular, and Atomic Spectroscopy

December 1st 2018Mass spectrometry, molecular and atomic spectroscopy technologies combine to represent more than a fifth of the overall market for laboratory analytical instrumentation. These techniques are perhaps the most broadly used instruments, with utility in pharmaceuticals and other life sciences, chemicals, environmental, food, clinical/Dx and other applications.