Government Budget Cuts Hamper Spectroscopy Market Growth

In light of recent economic changes, such as the sequester in the United States, Strategic Directions International, Inc.'s president and CEO Lawrence Schmid provides an updated forecast for the spectroscopy market, specifically the molecular spectroscopy, atomic spectroscopy, and mass spectrometry sectors.

In light of recent economic changes, such as the sequester in the United States, Strategic Directions International, Inc.'s president and CEO Lawrence Schmid provides an updated forecast for the spectroscopy market, specifically the molecular spectroscopy, atomic spectroscopy, and mass spectrometry sectors.

The global economic situation has deteriorated somewhat as the result of macroeconomic events in the United States and especially Europe. In addition, developing nation growth has slowed, particularly in China, partly as the result of the global situation, but also because of developmental difficulties in China itself. During the early months of 2013, most forecasting groups became more circumspect and began to lower estimates of global economic growth for 2013 and 2014. Prospects in the United States have been trimmed and expectations for Europe continue to be mostly gloomy, while growth prospects for China and India have also been lowered.

The economic outlook in the United States dimmed significantly as the result of government actions, although some might say inactivity. Specifically, something referred to as "sequestration." Actually, the term budget sequestration (or sequester) refers to automatic spending cuts in particular categories of federal outlays. In 2013 specifically, sequestration refers to a section of the Budget Control Act of 2011 that was initially set to begin on January 1, 2013, as an austerity fiscal policy. These cuts were postponed by two months by the American Taxpayer Relief Act of 2012 until March 1, 2013, when this law went into effect.

The reductions in spending authority are approximately $85 billion during fiscal year 2013, with similar cuts for years 2014 through 2021. The cuts are split evenly (by dollar amounts, not by percentages) between the defense and nondefense categories. The Congressional Budget Office estimated that sequestration would reduce 2013 economic growth by about 0.6 percentage points (from 2.0% to 1.4% or about $90 billion) and affect the creation or retention of about 750,000 jobs by year-end. The blunt nature of the cuts has been criticized, with some favoring more tailored cuts and others arguing for postponement, while the economy improves.

Growth has clearly slowed in the United States and the impact of the "sequester" is being felt more and more as each month passes. Difficulties in Europe have further impacted the United States because its major export customers are not exactly in a buying mood given the poor economic conditions, which are not expected to improve until 2014.

Spectroscopy is a key sector of the analytical and life science instrument industry. For many years the overall instrument industry and the spectroscopy segment in particular, has proven to be quite resilient while serving the scientific requirements for a vast array of applications in every conceivable industry. Growth has been fairly steady for the last decade, averaging around 6% annually. This market is now expanding at a lower, but generally stable rate. However, changing global economic conditions and governmental actions have had an increasing impact.

After assessing these events and trends and reviewing various industry data for 2012 and the developments so far in 2013, Strategic Directions International, Inc. (SDi), a consulting and market intelligence firm specializing in this market, has estimated the total worldwide market for analytical and life science instrumentation revenues will expand by about 3% in 2013 and reach a level of around $45 billion. Growth in 2014 is expected to exceed 5%.

Aftermarket purchases of products and services, including such items as consumables (especially chemicals), software updates, and accessories, has become an important aspect of the analytical and life science instruments market. As the installed base of instruments grows and the market matures, the aftermarket becomes especially important. In fact, in selected technology areas the aftermarket is a very significant product segment that is growing faster than instrument system revenues and is often more profitable. It is also true that for some technologies, instrument systems (hardware) may actually be declining in unit sales while the aftermarket provides at least minimal growth. So it should be noted that all the revenue projections in this article include the total mix of revenue sources: instrument system sales, aftermarket, and service.

The Overall Spectroscopy Market

The spectroscopy market can be segmented into three distinct sectors: molecular spectroscopy, atomic spectroscopy, and mass spectrometry (MS). The applications of the techniques included in each sector and their prospects differ significantly, especially within each sector. Worldwide revenues for all spectroscopy segments is estimated at about $10 billion for 2012, or about 22% of the entire laboratory analytical and life science instrument market.

The overall spectroscopy market is estimated to have increased just 1.2% in 2012, a disappointing suboptimal performance primarily because of the economic uncertainty that existed throughout the year and finally impacted the market. SDi projects spectroscopy market growth in 2013 to remain in a slow growth mode, but still expanding at a moderate rate of 2.7%. As with other analytical techniques, in 2011 the spectroscopy market was a beneficiary of the positive effects of a general return to global economic growth, and the last effects of government stimulus programs in several countries, especially in the United States, China, and Germany.

Unfortunately, the situation reversed in 2012 as economic conditions worsened throughout the world, but especially in Europe. While the pharmaceutical, biotechnology, and food industries still performed well, most industrial markets — particularly metals, chemicals, and semiconductor manufacturing — did poorly. In addition, government funding cutbacks took a toll on that sector as well as academia, which is dependent on governmental support. These were certainly lackluster markets for instrument suppliers. Some of these same developments have continued in 2013 and are preventing the spectroscopy market from making much of a comeback.

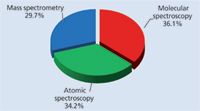

Molecular spectroscopy techniques accounted for more than 36% of the spectroscopy market in 2012, with several diverse techniques represented that address a wide range of applications in almost every industry category. Atomic spectroscopy is the second largest sector at more than 34%, and MS accounts for almost 30% of spectroscopy revenues. Figure 1 illustrates the fairly equal distribution of revenues from each spectroscopy market segment. Please note that liquid chromatography (LC) and gas chromatography (GC) front-ends to mass spectrometers, and their associated aftermarket and service revenues, are not included in this analysis.

Figure 1: 2012 spectroscopy market by sector ($9.9 billion).

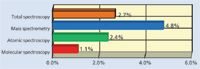

Figure 2 shows the relative projected growth rates for each market segment in 2013. Clearly, MS is expected to be the strongest performer, a continuation of the role it has played for several years.

Figure 2: Estimated growth by spectroscopy sector for 2013.

Initial system sales represented about 69% of spectroscopy revenues in 2012. Aftermarket purchases of accessories, software, and consumables accounted for approximately 18% of revenues and service revenues for service contracts, on-call service, value added services such as instrument validation, and spare parts combined for about 13% of the total market.

Molecular Spectroscopy

As predicted last year, the molecular spectroscopy market was not immune to a slow-growing economy, although the actual market decline of about 1% was an unexpected development. Several important segments of the market declined including nuclear magnetic resonance (NMR) spectroscopy, the largest segment, as well as ultraviolet–visible (UV–vis) and colorimetry. For 2013, the overall molecular spectroscopy market should increase at a minimal level of just over 1% held back by additional declines for NMR and colorimetry, albeit less so than for 2012. Most other segments of the market are expected to see fairly flat demand this year. Weakness in the academic sector and further cutbacks in government spending will offset most of the improving picture from other industrial sectors in 2013, but an inevitable rebound should lead to high single-digit growth in 2014.

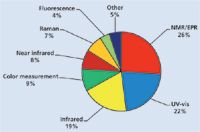

The NMR market, which has seen many years of double-digit growth, was hit by a substantial decline in 2012 as positive effects from stimulus spending gave way to government budget cuts, which impacted the academic market heavily as well. As governments continue to look to curtail spending in 2013, NMR demand is likely to decline somewhat in 2013. However, NMR is an extremely powerful technique, and a strong rebound is anticipated when the current period of government austerity is rationalized, most likely in 2014. Figure 3 illustrates the mix of molecular spectroscopy techniques. At more than one-quarter of the market, NMR demonstrates its significance.

Figure 3: 2012 molecular spectroscopy market by technique.

The UV–vis market is not only large, but extremely diverse, consisting of everything from simple, inexpensive photometric colorimeters used in water analysis test kits to high end UV–vis coupled to near-infrared (NIR) systems used in the electronics and materials industry. The various subsegments of the UV–vis market are expected to see very flat growth in 2013, with the lone exception being microvolume UV–vis, which is largely driven by the biotechnology and related industries. A broad rebound across industries should lead to much stronger growth across all areas of the UV–vis market by 2014.

Table I illustrates the differentiation growth prospects of the fastest and slowest growing techniques. As is discussed in the various sections of this article, MS has several leading techniques, and a few laggards, while molecular spectroscopy has no strong performers and several are actually declining, especially the important NMR segment. Atomic spectroscopy techniques generally fall in the middle, with X-ray diffraction (XRD) offering the best prospects.

Table I: Spectroscopy product growth prospects for 2013

Infrared (IR) spectroscopy will exhibit good growth in 2013, but less than experienced in recent years. Demand for portable IR instruments is helping to drive the market to some degree, with the oil and gas sector being a key to that area. However, the rise of terahertz spectroscopy will be the biggest driver of the IR market in 2013. Although terahertz spectroscopy appears to be more suited to process and industrial applications, it is rapidly becoming a significant percentage of the infrared spectroscopy market.

Color analysis instrumentation demand declined in 2012 and will likely show negative growth in 2013, although not as severe as seen in 2012. Danaher's acquisition of X-Rite last year, the strong market leader in color analysis, is likely to bring some changes to that market in terms of product development and application focus.

Demand for NIR and Raman are expected to see similar growth rates in 2013. The strong connection of NIR to the agriculture sector is helping to somewhat insulate it from the cuts in government and academic spending that impact most other analytical technologies. In contrast, demand for Raman spectroscopy, which has seen very strong growth in recent years, is much more reliant on government and academic demand, resulting in a second consecutive year of low single-digit growth.

Demand for fluorescence and luminescence competes against microplate readers, which are not included as spectroscopy techniques. However, growth in industries such as environmental analysis is helping to maintain some level of growth. Demand for ellipsometry is heavily tied to the semiconductor electronics industry, which is a highly cyclical market, and should result in a modest rebound in 2014.

Many suppliers are involved in the design, manufacture, and sale of molecular spectroscopy instrumentation. Overall market share position, however, tends to be a function of dominance in particular product segments. Bruker continues to lead the molecular spectroscopy vendor share by a considerable margin because of its extremely strong position in the large NMR market coupled with its important role in IR spectroscopy. Thermo Scientific is a strong number two among molecular spectroscopy vendors because of its leading position in the UV–vis and IR markets as well as its growing position in Raman spectroscopy. Agilent Technologies holds the number three position based on its NMR business and several other molecular spectroscopy techniques, especially UV–vis. Danaher with its strong role in water analysis related instruments, coupled with its acquisition of X-Rite, a dominant player in the color analysis market, has now moved into the number four market share position.

PerkinElmer remains a potent supplier of a variety of molecular spectroscopy instruments, especially UV–vis- and IR-based instruments. FOSS's dominance in NIR makes it one of the more significant molecular spectroscopy suppliers. Other important molecular spectroscopy suppliers include Shimadzu, JASCO, Horiba, and JEOL, all headquartered in Japan.

Atomic Spectroscopy

Atomic spectroscopy instruments generally provide information about the elemental composition of a sample, based on some form of light used to probe the sample. SDi identifies nine specific subtechnologies in this category, and each has its pluses and minuses for particular applications. The total market demand for atomic spectroscopy instruments is forecast to grow to nearly $3.5 billion in 2013. This represents growth of about 2.5% for the year, an increase over the somewhat troubled market last year, which saw only very small gains. While some technology segments experienced small decreases last year, 2013 should usher in growth for all of the product segments in atomic spectroscopy.

XRD is forecast to be the fastest growing technique, with growth approaching 5% for the year. Unlike most atomic spectroscopy techniques, XRD is not primarily used for elemental composition; rather it is used to determine or identify molecular structures. XRD has strong research applications in academic, government, and industrial laboratories in pharmaceuticals and biotechnology. Although budget constraints are affecting those markets, XRD continues to evolve as a technique with more automation and larger, faster detectors offering better performance, boosting both the price and demand for new systems.

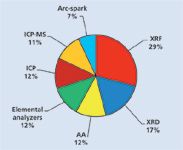

Figure 4 provides a breakdown of the atomic spectroscopy market by technique. The significance of X-ray techniques becomes apparent as X-ray fluorescence (XRF) and XRD techniques combine to represent almost 50% of the market.

Figure 4: 2012 atomic spectroscopy market by technique.

The markets for inductively coupled plasma optical emission spectroscopy (ICP-OES) and ICP-MS techniques are also growing nicely. Both are standard elemental analysis techniques for environmental testing and many other uses. ICP-MS has high sensitivity and allows for the detection of some trace elements at part-per-quadrillion concentrations. ICP is a workhorse environmental technique, and ICP-MS is gaining ground due not only to increasingly strict environmental regulations, but also more interest in the effects of trace elements on health.

The remaining atomic spectroscopy techniques are forecast to experience growth only in the low single digits. Some techniques, like atomic absorbance (AA), are very standard techniques and generally do not provide much growth. Others, like arc-spark and XRF, are hindered by continuing uncertainties in the global economy, and in particular, weaknesses in the metals and consumer electronics markets. However, handheld XRF units continue to exhibit good growth as the applications for on-site analysis expand and the technique gains acceptance. Growth in this segment was less than 5% for 2012, but should approach 7% in 2013.

Looking further on to 2014, SDi expects the economic and industrial situation to improve markedly, and growth for all segments of atomic spectroscopy should accelerate through this year and into next year, when overall growth for the sector is forecasted at around 5%.

Although no one vendor dominates this market, several have very strong positions in closely related technologies. PANalytical (Spectris plc), Bruker, Rigaku, and Thermo Scientific are strong in the X-ray technologies. Given that these are the largest markets, these four vendors are among the top six for all of atomic spectroscopy. Thermo Scientific is at the top of the list because of its broad performance in virtually all of these technologies, while the other three are more concentrated. PerkinElmer and Agilent are major players in AA, ICP, and ICP-MS. LECO is a major player in the elemental analyzer market, and Spectro Analytical (AMETEK) leads the arc-spark market. Hitachi was formerly a relatively minor player in AA and elemental analysis, but has now become a more significant competitor following its acquisition of SII Nanotechnologies, which adds ICP, ICP-MS, and XRF to Hitachi's atomic spectroscopy portfolio. Other significant suppliers in this market include Horiba, Oxford Instruments, and GE Analytical.

Figure 5 shows the annual revenues for each product segment from 2011 to 2014. As the molecular spectroscopy market has slowed and MS continues it good growth record, a gap between the two has narrowed.

Figure 5: Spectroscopy market by product segment ($ billion).

Mass Spectrometry

Overall MS demand growth is expected to be a little less than 5% in 2013, which is still better than the sub-4% growth seen in 2012, but well under the more typical pace of around 10% in recent history. With the lone exception of portable and in-field MS, all categories of the technique are expected to see somewhat better growth in 2013. Major overall trends in the market include increasing competition between the major vendors as they expand into more segments of the market, and significant moves by many of the leading vendors to position themselves to address the growing clinical analysis sector.

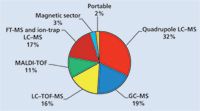

Figure 6 provides a breakdown of the various product segments in the MS market. Quadrupole LC–MS is by far the largest product segment with almost a third of the market. Quadrupole LC–MS, which includes both single- and triple-quadrupole instruments, will soon eclipse the $1 billion mark in annual sales. The strong pace of technological improvements in triple-quadrupole sensitivity and performance continues to drive demand for high-end systems, while innovations trickle down rapidly to routine triple- and single-quadrupole models as well. The entry of Shimadzu into the triple-quadrupole segment in 2011, followed by Bruker in 2012, has made the triple-quadrupole LC–MS area extremely competitive, with all six of the major mass spectrometer system suppliers now involved.

Figure 6: 2012 mass spectrometry market by technique.

Single-quadrupole instruments dominate the installed base for GC–MS systems and provide a very strong driver for replacement sales. However, most of the near-term growth in GC–MS is expected to come from the development of demand for triple-quadrupole GC–MS models, which is rapidly becoming a more routine analytical tool. The relaunch of the former Varian business by Bruker and the entrance of Shimadzu into the triple quadrupole segment now doubles the number of major system suppliers in the area. Another stimulus to growth of the GC–MS market has been the development of a commercial quadrupole time-of-flight (QTOF) GC–MS by Agilent, which is helping to drive the smaller GC–TOF portion of the market. Improvements in other GC–MS technologies are beginning to minimize many of the advantages of ion trap technology, which is expected to see flat to slightly declining demand for the foreseeable future.

Fourier transform mass spectrometry (FT-MS) systems, which are nearly all configured as LC–MS systems, and ion-trap LC–MS have been grouped together because they both are based on various types of ion-trap designs. Although ion-trap LC–MS is still the larger percentage of the market segment, the return to double-digit growth for FT-MS is what will drive demand in 2013. With the discontinuation of Agilent's high-end FT-MS business, and a minimal presence by Thermo Scientific, Bruker has become the principle supplier of such systems.

Thermo Scientific focused its efforts in this area on its orbital trap–based FT-MS instruments, which are proving to be quite popular, despite facing intense competition from the QTOF LC–MS systems of other vendors. Demand for ion-trap LC–MS is expected to see fairly slow growth as end-users continue to shift away from conventional designs in favor of linear and other, more novel, ion-trap LC–MS designs.

The vast majority of demand for LC–TOF-MS comes from QTOF systems, and is expected to see the strongest growth of all MS technologies in 2013. Most, if not all, of the major QTOF vendors have continued to make significant performance improvements annually, which has helped drive double-digit growth in most years. There has been considerably less developmental focus on LC–TOF development, as the configuration does not allow for the use of most ion fragmentation techniques, and therefore growth in demand should continue to be much more modest.

Demand for MALDI-TOF should be in the mid-single-digits in 2013, and likely stronger beyond that, as vendors, end-users, and regulators are developing effective pathways to implementation of MS in clinical analyses. Magnetic sector demand is largely relegated to niche applications and will continue to gradually wane. Demand for portable and in-field MS is dominated by government purchases, which is likely to take a significant hit in demand in 2013 before rebounding somewhat.

During the last few years, portable MS has developed into a major segment of the market with advances in miniaturization and ruggedness, and growing interest in instrumentation focused on security. Unfortunately, a good portion of the demand for portable MS is reliant on government spending, especially for military applications. Government spending cutbacks have, therefore, impacted the growth of portable MS, which is now slightly negative, but should rebound in 2014.

Industry consolidation and heightened competition during the last few years has concentrated market shares with six firms now accounting for over 85% of the MS market. AB Sciex is the market leader based on its dominance in quadrupole LC–MS coupled with strong TOF-MS offerings. The other major MS vendors include Thermo Scientific, Agilent Technologies, Waters, Bruker, and Shimadzu, all of which offer a number of MS techniques. Although not as broad-based, suppliers such as PerkinElmer in GC–MS, LECO in GC–TOF and LC–TOF, and JEOL in magnetic sector technology maintain important positions in their respective areas of emphasis.

Countering the Effects of the Economy and Government Policies

Although manufacturers of spectroscopy instruments cannot directly influence government actions or reverse economic stagnation, they can make it easier for scientists to address their analytical challenges and laboratory throughput issues by introducing innovative instrument systems that are more easily justified, even in a dour economic climate.

Innovation in the spectroscopy market has been a positive force in driving market demand for many years. The innovation comes from a push–pull effect between instrument companies and scientists that typically results in instruments being developed that meet the needs of the scientific community. Of course, new and improved instruments must be available to stimulate buyer interest, and business requirements and budgets must be sufficient to justify instrument purchases. However, justification can be multifaceted. Certainly higher performance in terms of sensitivity and resolution can be of great interest to scientists seeking analytical breakthroughs, but that is not necessarily of paramount concern in every laboratory.

New and more-demanding applications have also found spectroscopy techniques to be convenient solutions for analytical challenges, especially when developed for the users in more usable configurations and with improved performance capabilities as compared to older instruments. Hand-held and portable instruments have helped to bring analytical techniques to the sample and not the other way around. So field analysis has become a more viable approach, which is invaluable to scientists and technicians endeavoring to identify hazardous substances in water, soil, clothing, and food.

Likewise, spectroscopy technologies have been found to be indispensable for security and defense, drug identification, food inspection, and environmental monitoring. These and other applications can benefit from the development of more cost effective systems that are easier to use and are available in more convenient packages. Including more analytical technologies in a single instrument can be an important option, as is developing instruments for very specific purposes at lower price points. There are many ways to stimulate the market beyond producing the most sophisticated high-priced instrument on the market.

The various types of spectroscopy techniques address different analysis challenges and collectively represent a set of solutions available to the scientist. And while many instruments compete with another, invariably a particular instrument does the job better than others. So, this diversity and scope contributes to spectroscopy's continued importance and presence in laboratories around the world. But this diversity can also minimize vulnerability to sectors of the economy most affected during economic downturns by addressing applications in markets such as the healthcare and pharmaceutical industries that are driven by different dynamics than the overall economy.

Of course, it would very much be hoped that some adjustment could be made to the current budget constraints on budgets for government funded scientific research in the United States and elsewhere. Such endeavors have proved instrumental in advancing technology for the benefit of mankind. Spectroscopy instrumentation has been especially useful to scientists involved in these research efforts. These large markets have also enabled instrument suppliers to provide the needed innovation.

Lawrence S. Schmid is the President and Chief Executive Officer at Strategic Directions International, Inc., in Los Angeles, California. Please direct correspondence to: lschmid@strategic-directions.com

Best of the Week: AI and IoT for Pollution Monitoring, High Speed Laser MS

April 25th 2025Top articles published this week include a preview of our upcoming content series for National Space Day, a news story about air quality monitoring, and an announcement from Metrohm about their new Midwest office.

LIBS Illuminates the Hidden Health Risks of Indoor Welding and Soldering

April 23rd 2025A new dual-spectroscopy approach reveals real-time pollution threats in indoor workspaces. Chinese researchers have pioneered the use of laser-induced breakdown spectroscopy (LIBS) and aerosol mass spectrometry to uncover and monitor harmful heavy metal and dust emissions from soldering and welding in real-time. These complementary tools offer a fast, accurate means to evaluate air quality threats in industrial and indoor environments—where people spend most of their time.