The Spectroscopy Market Hits a Bump in the Road

Lawrence Schmid updates his look at the state of the spectroscopy market as the global economic recession continues.

The analytical and life science instrument industry, of which spectroscopy is a key component, is an important resource for dealing with global challenges of ever-increasing magnitude. Overall industry growth has been in the 6 to 8% range for the last few years, which is a sign of its maturity and stability. The demands of the life science marketplace, environmental concerns, the search for new materials, and security and defense concerns are important driving forces. The regional focus has shifted to developing countries, especially in Asia, where growth far outpaces that of North America, Europe, and Japan. But even as application requirements evolve and markets ebb and flow, 2009 is shaping up as a major challenge for every industry, including the laboratory instrument industry, and indeed the spectroscopy segment as well. The global economic recession we are experiencing is without precedent in living memory and the uncertainty about how this will resolve is equally high.

Not a day goes by without seeing more bad news, whether it be the financial meltdown, bankruptcies, growing unemployment, a slowdown in global trade, as well as the gloom surrounding global stock exchanges. We are clearly in the midst of a global recession, which cannot be easily dismissed. Still, we are seeing unprecedented government intervention throughout the world to stem the tide of decline. Stimulus programs in the US, EU, Japan, China, and many other countries are bound to moderate the economic problems, as does the fact that interest rates are at extremely low levels, which should at some point encourage consumption and investment.

Table I: Spectroscopy product growth prospects for 2009

With these developments in mind, and after examining any and all indications of industry activity in 2008 and the prospects for 2009, Instrument Business Outlook (IBO), a publication of Strategic Directions International, Inc. (SDi), a consulting and market intelligence firm specializing in this market, has estimated the total worldwide market for analytical and life science instrumentation and related aftermarket and service revenues at just under $38 billion for 2008. This represented an overall increase in industry revenues of about 5.1% from 2007, which was less than expected because of the global economic slowdown that surfaced in the last three months of 2008. SDi forecasts the analytical and life science instrument industry to experience negative growth for 2009 of about –4.5%. This would be the first year-to-year decline since 1983. While disappointing, it is a level of performance that would be very welcome in many sectors of the global economy and not nearly the gloomy overlook that some analysts have predicted for the industry. That said, it is apparent that even this resilient business is being affected by the worsening global recession.

Some instrumental techniques will, however, suffer more as the primary industries they serve cut back, including metals and mining, petroleum and chemical processing, and of course, semiconductor and electronics. On the other hand, those techniques that deal with the life sciences (pharmaceuticals, biotechnology, and food and agriculture testing) will weather the storm fairly well. Likewise, some regions of the world, like China and India, will continue to offer growth potential, but at a somewhat less robust level. It is clear, based on reports for the first half of 2009, that this has been a particularly difficult time for the industry in general, and while we expect the second half to improve as the recession winds down and the stimulus kicks in, the year will show a loss in demand.

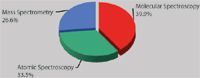

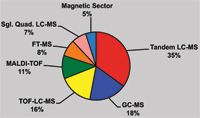

Figure 1: 2008 Spectroscopy market by sector ($8.8 billion).

The pace of global mergers and acquisitions slowed somewhat during the last year or so. However, several deals did take place of significance, especially two blockbuster transactions. Most recently, Agilent Technologies, Inc. announced in late July that it was acquiring Varian, Inc., its neighbor in Silicon Valley. The combination will significantly broaden Agilent's involvement in both atomic and molecular spectroscopy and make it one of the two leading suppliers in the overall analytical instrument industry, with almost $1 billion of spectroscopy revenues. In November 2008, Invitrogen acquired Applied Biosystems and quickly changed the name of the new organization to Life Technologies Corporation. The newly designated company is a powerhouse in life science technologies and includes various instrumental techniques, such as Real-Tine PCR, DNA sequencers, and mass spectrometers, as well as a plethora of reagents and kits for molecular biology and cell analysis.

Interest in aftermarket products and services, including such items as consumables (especially chemicals), software updates, and accessories, is keener than ever. As the installed base of instruments grows and the market matures, the aftermarket becomes especially important. In fact, in selected technology areas the aftermarket is a very significant product segment that is growing faster than instrument system revenues and is often more profitable. It is also true that for some technologies, instrument systems (hardware) may actually be declining in unit sales while the aftermarket provides at least minimal growth. So it should be noted that all the revenue projections in this article include the total mix of revenue sources: instrument system sales, aftermarket, and service.

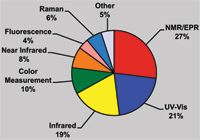

Figure 2: 2008 Molecular spectroscopy market by technique.

The spectroscopy market can be segmented into three distinct sectors: molecular spectroscopy, atomic spectroscopy, and mass spectrometry. The applications of the techniques included in each sector and their prospects differ significantly, especially within each sector. Worldwide revenues for all spectroscopy segments are estimated at $8.8 billion for 2008, or about 22% of the entire laboratory analytical and life science instrument market. The overall spectroscopy market is estimated to have grown 5.3% in 2008, a significantly lower level than what was predicted last year. SDi projects the spectroscopy market to actually decline in 2009 at the rate of –1.9%. This is a function of the fact that most of the growth markets have cooled off and because of the more intense level of the global economic slowdown. A major reversal of fortune for the spectroscopy market can also be laid at the foot of more expensive high-performance instrument systems. Instruments such as high-end mass spectrometers and nuclear magnetic resonance spectrometers, which have led the growth wave of the past several years, are now suffering, at least in terms of initial system sales. Still, the spectroscopy market is projected to grow faster than several segments of the overall laboratory instrument market, which are more dependent on industry applications.

Molecular spectroscopy techniques account for almost 40% of the spectroscopy market, although many diverse techniques are represented that address a wide range of applications in almost every industry category. Atomic spectroscopy is the second largest sector at over 33%, while mass spectrometry approaches 27% of spectroscopy revenues. Please note that liquid and gas chromatography front-ends to mass spectrometers, and their associated aftermarket and service revenues, are not included in this analysis.

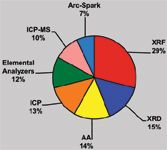

Figure 3: 2008 Atomic spectroscopy market by technique.

Molecular Spectroscopy

The market for molecular spectroscopy is estimated to have exceeded $3.5 billion in 2008. Overall, the total revenues for all categories of molecular spectroscopy grew 6.0% last year. However, growth rates differ measurably for the various instrumental techniques, led by the continuing success of the nuclear magnetic resonance (NMR) segment, while fluorescence spectroscopy has experienced the slowest growth. No single technique dominates this market, although the NMR and UV-Vis product segments account for almost 50% of the overall molecular spectroscopy market.

The deep global recession will take its toll on the overall molecular spectroscopy market, which is expected to decline 3.8% for 2009. With the exception of color measurement and ellipsometry, most other molecular spectroscopy instrumentation techniques are significantly focused on selected industries that are seen as being largely insulated from the current economic crisis, namely healthcare, government, and academia.

Figure 4: 2008 Mass spectrometry market by technique.

The consistently solid growth of the vibrational spectroscopy methods, which include Raman, infrared (IR), and near-infrared (NIR), is in large part due to the rapid rise of portable handheld molecular spectroscopy instruments. The technological advancements made during the telecommunications revolution of the late 1990s made possible much more compact, reliable, and robust instruments that required less power. When combined with major advancements in battery technology, the result was a slew of new handheld spectroscopy instruments. Much of the new demand for these products is coming from various government entities for defense, domestic security, and first-responder usage, as well as from environmental applications. The quality and performance of many of these handheld instruments also rival that of lower-end benchtop systems, which will tend to cannibalize a significant portion of those market sub-segments. Both IR and NIR are expected to expand in the low single-digits. Demand for Raman spectroscopy has now reached quite sizable proportions, and the technique will continue to be the standout performer for the near-term.

The major weak areas in the molecular spectroscopy market are color measurement and ellipsometry, and surprisingly, nuclear magnetic resonance. Much of the demand for color measurement comes from the textiles and automotive industries, which have collapsed in 2008, and are likely to continue downward in 2009, taking demand for color analysis instrumentation with them. By far the largest demand for ellipsometry comes from the semiconductor & electronics industry. Although some segments of this industry are doing well, such as photovoltaic cells for solar arrays, most of the industry is considerably depressed, and is not likely to pick up any time soon. NMR, traditionally a growth segment, has been especially hit hard by the global recession, and the marketplace's focus on genomics where NMR does not play has affected it as well.

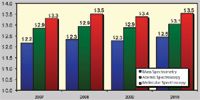

Figure 5: Spectroscopy market by product segment ($ billion).

The NMR market, which is by far the largest segment of the molecular spectroscopy market at over $1 billion, will see revenues decline about 8% in 2009. The extremely high cost of higher-end NMR initial systems has caused many end-users to pause and reconsider such large capital expenditures in the current economic environment. However, nearly a third of demand comes from academic and government research laboratories, which are somewhat insulated from the wider economy. The other factor helping to maintain consistent demand in the NMR market is the installed base, and the considerable amount of service and aftermarket products, such as probes and cryogenic gases, that are required to maintain and operate such systems.

Like other molecular spectroscopy markets, growth in demand for UV-Vis and polarimeters & refractometers will be down slightly, but not dramatically. Most of the instruments in both of these areas are relatively low cost, priced between a few hundred and a few thousand dollars. Therefore, such purchases are not highly dependent on major capital expenditure decisions by end-user organizations. The UV-Vis market is also benefiting from the rapid increase in demand for micro-volume instruments, which are heavily tied to the biotechnology and hospital/clinical industries.

Figure 6: Estimated growth for the spectroscopy sector for 2009 and 2010.

Fluorescence instrumentation is also tied to the life science market, but standalone instruments continue to exhibit sluggish demand. This is primarily because of microplate readers that often include a fluorescence detection mode and offer productivity improvement potential for many applications.

A very large number of suppliers participate in the molecular spectroscopy market, however, overall market share positions tend to be a function of dominance in particular product segments. Bruker is the overall leader based on its very significant NMR/EPR business as well as its involvement in infrared technology. Varian is also a major NMR vendor with a leading role in UV-Vis. Thermo Scientific and PerkinElmer, in the third and fourth positions, offer a wider array of molecular spectroscopy instruments, but with very strong positions in infrared and UV-Vis. X-Rite holds the number 5 position based on its dominance in color measurement.

Specialty suppliers like Hach Danaher in UV-Vis for water analysis, Foss in food and agricultural NIR and IR, and Horiba in Raman and fluorescence are key participants in their respective areas of focus.

Atomic Spectroscopy

The market for atomic spectroscopy instruments is expected to slow measurably in 2009 and decline by 2.6%, a significantly lower level than has been seen in many years. However, within this $3 billion market, growth varies widely for the techniques included. During the last two to three years, market demand for atomic spectroscopy instrumentation has especially benefited from the increased global demand for minerals and metals and their concomitant high prices, as well as by recently enacted environmental regulations. This continued until mid-summer 2008, when the air went out of the mineral and metals balloon.

Many atomic spectroscopy techniques are well suited for the analysis of trace elements in water and other sample types; consequently, they have a strong environmental focus. Because a large portion of environmental testing is mandated by regulations, these applications should be fairly insulated from the negative effects of the global economy. The continuing international interest in green technologies and environmental safety should also remain strong sources of growth in demand for atomic spectroscopy. The techniques most associated with environmental testing are atomic absorbance (AA), inductively coupled plasma (ICP) spectroscopy, ICP–mass spectrometry (ICP-MS), and the various elemental analysis techniques. Traditionally, these techniques grow at single-digit rates, but not so for 2009. Only ICP-MS is likely to exhibit any growth, which would be attributable to its low-level detection limits for trace elements. Both AA and ICP will experience revenue declines of about 5%. The situation would be worse were it not for the support these markets get from aftermarket and service revenues. The fastest growing segment is in elemental analysis, where total organic carbon analyzers (TOC) continue to expand their reach into industrial markets and other types of water analysis. Organic elemental analyzers will see modest growth of about 3% because of their focus on food and agriculture, while the inorganic analyzer market, a technology area closely associated with metals analysis, will expand at a slower rate with the exception of mercury analysis, which is still very much in demand.

On the other hand, some atomic spectroscopy technologies can expect to be affected more severely by the global economic downturn. Production of metals severely diminished since the heydays of 2007 and early 2008. This will not only affect steel production for products like automobiles, but other metals as well, such as aluminum. Arc-spark spectroscopy is strongly tied to metal production, and this market is forecast to fall over 10% in 2009. X-ray fluorescence (XRF) and, to a lesser extent, X-ray diffraction (XRD), also have strong ties to metals and mining, but these technologies have important applications in other areas that should moderate the negative effects. Nevertheless, although the X-ray technologies have recently grown at double-digit rates, the forecast for 2009 will fall well short of that level. Indeed, XRF will not grow much at all in 2009, though this may reflect more on how good a year 2008 was for XRF. Handheld XRF has enjoyed enormous growth as it expanded the technology into new markets, but even in 2008 it was already becoming more difficult to find new areas into which to expand. In contrast, XRD should continue to receive support from academic and government spending, making the technology the category growth leader at about 5%. Although arc-spark will suffer a significant decline, it is the smallest market. With only a few bright spots in the atomic spectroscopy arena and with most technologies posting declines to various degrees, the overall market is still forecast to decline almost 3% in 2009, buoyed primarily by XRD and elemental analysis.

The total atomic spectroscopy market is fairly consolidated, with the top five vendors combining to make up nearly half of the market. There has been a recent trend among the suppliers of X-ray instrumentation to pursue acquisitions or other business relationships in related areas of spectroscopy, primarily arc-spark. For instance, Bruker has acquired Quantron (arc-spark) and JUWE (elemental analysis), Oxford Instruments acquired WAS (arc-spark), and PANalytical (Spectris) has formed a close relationship with OBLF (arc-spark).

Spectris, Bruker, and Rigaku, which all participate primarily in X-ray spectroscopy, hold the third through fifth spots in overall vendor share. In second place, PerkinElmer relies on its dominance in the more environmentally focused technologies: AA, ICP, and ICP-MS. Thermo Scientific is the leading atomic spectroscopy supplier. Thermo competes in all of the individual technology areas within atomic spectroscopy, a distinction it shares only with Shimadzu. More focused players dominate in some markets. The prime examples would be Spectro Analytical (AMETEK), which leads the arc-spark market, and LECO, which rules the field of elemental analysis.

Specialty-oriented suppliers such as Teledyne Leeman, with its environmental orientation for ICP and mercury analyzers, Analytik Jena in AA and inorganic elemental analyzers, and Innov-X with handheld XRF analyzers, and several others, are important contributors.

Mass Spectrometry

It should be no surprise that the mass spectrometry market is once again the growth leader in spectroscopy. The unique capabilities and technical performance of various mass spectrometry products helps to drive demand for these instruments, especially for the increasingly challenging analytical applications in today's modern laboratory. The worldwide market for mass spectrometry easily passed the $2.3 billion mark in 2008 as revenue growth exceeded 7.4%. Despite the severe global recession, SDi only expects the demand for mass spectrometry to decline 1.8%, which will keep the total market at just under the $2.3 billion mark. The fact that more than two-thirds of the mass spectrometry market is closely connected with government, academia, and the healthcare industry is the primary factor for its demand resiliency. A stream of new product introductions advances the limits of performance and is a major factor for the support that this technology is given by scientists throughout the world.

There has been a softening in demand for initial systems, especially for the more expensive systems that can cost over half-a-million dollars. New orders for initial systems are either being delayed or put on hold, rather than canceled outright, as end-users are simply becoming more cautious in the current economic environment. Mass spectrometry plays an important role in certain industries such as pharmaceuticals, biotechnology, environmental testing, and increasingly clinical applications, which exhibit a continuing requirement for ever-increasing sensitivity, resolution, and speed of analysis. This often trumps economic concerns when it comes to resource allocations related to capital equipment investment. The fairly large installed base and strong continued growth of the past years suggests very consistent growth in aftermarket and service demand for mass spectrometry.

One market segment that has been somewhat more affected by the general economic downturn is GC–MS, which is significantly associated with the oil and gas industry and petrochemical manufacturing. The price of oil has plummeted during the past few months and diminished some of the attraction of that market. The chemicals industry is likewise confronted with reduced global demand for its products and capital budgets have been drastically reduced. However, food safety issues and environmental regulations will help GC–MS counteract the slowdown for petroleum and chemical applications.

The once high-flying MALDI-TOF market has experienced less than stellar growth in recent years because of a lack of product innovation. Market demand is expected to be flat to slightly decreased for 2009. While initial systems demand has been soft, one bright spot is the interest in the technology that has been stimulated by the development of a wide range of sample prep and other aftermarket products.

Both tandem LC–MS and TOF LC–MS flirted with growth of about 9% in 2008. For 2009, growth for TOF LC–MS will be minimal, while tandem LC–MS could be down as much as 5% because of the present economic conditions. Another factor contributing to lower prospects for these techniques is the availability of significantly lower priced initial system models of triple quadrupole and Q-TOF instruments, which has reduced average selling prices, while maintaining growth in unit sales. However, several MS vendors report strong sales of their highest performance mass spectrometers, which suggests that analytical requirements can trump poor economic conditions, especially in government and academic labs. Continuing innovation and new product introductions in these two segments of the market will help drive market demand for the next several years. Food safety issues have also helped to stimulate demand for this segment of the market, particularly for triple quadrupole LC–MS. Because food safety is driven much more by regulatory factors, it is also likely to be less affected by recessionary pressures.

The FT–MS market is in major flux at the moment due to the introduction of much simpler and lower cost instrument models that fall into the category, principally from Thermo Scientific. These newer systems are priced well under $500,000 and are selling very well, which is in contrast to the much larger, and much more expensive, research systems that can cost over $1 million. Although these higher-end FT–MS systems are still in demand, their low volume and high cost means that only a handful of delayed or canceled orders could significantly affect market forecasts. Despite these factors, FT–MS should exhibit modest growth for 2009. Because FT–MS instruments offer the highest performance, they will continue to do well in the most demanding situations.

There has been a high degree of industry consolidation during the last several years, and now five firms account for almost 80% of the mass spectrometry market. Applied Biosystems, now part of Life Technologies, is the market leader, followed by Thermo Scientific, Agilent Technologies, Waters, and Bruker, all of which offer a number of mass spectrometry techniques. Competition among these suppliers has intensified, as has the competition between various technologies.

Although not as broad-based, suppliers such as Shimadzu in MALDI/TOF, LECO in GC/TOF and LC/TOF, and JEOL in magnetic sector technology maintain important positions in their respective areas of emphasis.

The Spectroscopy Market Is Well Positioned to Weather the Storm

There is no question that the diversity and scope of spectroscopy contributes to its continued importance and presence in laboratories around the world. Its utility has even moved beyond the lab due the advent of innovative handheld instruments for analytical challenges that cannot easily be addressed in a laboratory. This was most evident in handheld XRF instruments that have been used to reduce lead contamination of waste disposal sites and nearby groundwater and to detect the presence of lead in toys, and most recently, to comply with new regulations in the U.S. relating to lead in children's clothing. In addition, a host of new handheld instruments based on IR, NIR, UV-Vis, and Raman technologies are sweeping the market for security and defense, drug identification, food inspection, and environmental monitoring.

Atomic spectroscopy techniques are most closely associated with environmental applications and the analysis of metals and minerals, which until mid-2008 were all important sources of growth. The global economic slowdown has impacted this portion of the spectroscopy market the most, but it has not been a knockout punch. Water quality concerns still drive demand for ICP-MS and TOC and provide some support to the more mature AA and ICP markets. Likewise, XRD continues to benefit from its indispensable service in drug development. And while the metals and semiconductor industries may be disappointing this year for arc-spark and X-ray instrument suppliers, a return to stronger growth is perhaps only one or two years away.

So while the last few years have been an elemental analysis heyday, today it is a molecular world. Obviously, this change is a welcome trend by molecular spectroscopy and mass spectrometry vendors alike. Drug development, cell analysis, food testing, and pesticide analysis all depend on molecular analysis technologies, and the demand today is indeed a good counterweight to the less exciting prospects for atomic spectroscopy.

Internationally, China, India, and other Asian countries, excepting Japan, are where the growth can be expected, although somewhat muted as compared to the last few years. China's export engine is beginning to sputter as its global customers struggle through their economic doldrums, so it is likely that China will focus more attention inward. What is important is that the demand in China and surrounding countries will still outpace that in developed countries, and of course, the Chinese market is no longer tiny. It will remain a significant market for the full range of spectroscopy technologies, even those like arc-spark and AA, which have dimmer prospects in North America and Europe. Likewise, India will continue to be a growth market for technologies that support its expanding pharmaceutical and biotechnology industries. Many pharmaceutical companies are relocating operations to India to join its large domestic industry. India was once a market known only for generic drug production, but now it is becoming a location for new drug development as well. China has also made progress in these activities as well.

Although the current economic environment is somewhat depressing, we believe that improvements are on the horizon. We also feel that the utility of the vast range of spectroscopy technologies offers the kind of diversification that is needed in an uncertain world. Because of technical developments and product innovation, spectroscopy suppliers can be expected to continue to offer attractive analytical solutions to challenges new and old today and in the years to come.

Because we are at the halfway point of 2009, it is appropriate to look further into the future, especially since 2009 is shaping up as something of a "drag." The question is, will 2010 be equally as glum as 2009? We think not. We actually feel that 2010 will be a good year for spectroscopy, although not likely as robust as the 2006 to 2008 period. Still, we believe overall growth in the spectroscopy market will average 6%, with mass spectrometry leading the way. GC–MS is expected to be very vibrant, while other routine MS techniques will experience renewed growth as quality control and analytical services labs replace older instruments. The turnaround will, however, be most pronounced in atomic spectroscopy because of the expected rebound in metals and minerals production, and the pent-up demand due to more than 18 months of lackluster activity. Arc-spark and ICP should shine.

Lawrence S. Schmid is President and Chief Executive Officer, Strategic Directions International, Inc., Los Angeles, California. For more information on Instrument Business Outlook or other instrumentation research, contact Strategic Directions International, Inc. 6242 Westchester Parkway, Suite 100, Los Angeles, CA 90045, (310) 641-4982, fax; (310) 641-8851, e-mail: sdi@strategic-directions.com