The Spectroscopy Market Hits Its Stride

The spectroscopy market has benefited from the general return to global economic growth.

Spectroscopy is a key sector of the analytical and life science instrument industry. For many years, the overall instrument industry, and spectroscopy in particular, has proven to be quite resilient while serving the scientific requirements of a vast array of applications in every conceivable sector. Growth has been fairly steady for the last decade, averaging around 6% annually until recently. Compared to the double-digit growth seen during the 1980s and 1990s, most would agree that this instrument market is both mature and stable.

In 2010, after a difficult 2009, laboratories resumed their interest in purchasing new instrument systems, partly because of latent demand and the availability of new systems. Many instrument suppliers timed new product introductions to coincide with a resumption of market demand, and that strategy paid off. Likewise, aftermarket purchases picked up as inventories of supplies ran low and testing requirements increased. This was particularly true for academic and government laboratories, but also for general industry, electronics, pharmaceuticals, and biotech. Demand was very strong in emerging markets, especially China, India, and Latin America, but also in North America. Europe and Japan lagged behind.

Now that 2010 has come to an end on a high note, it is time to look ahead to the coming year and the prospects for the analytical and life science instrument market. Based on the trends that have been seen during the last half-year, it is safe to say 2011 will be a good year. The demands of the life science marketplace, environmental issues, the search for new materials, and security and defense concerns are important driving forces. Additionally, economic trends are encouraging. In October 2010, the International Monetary Fund (IMF) issued its World Economic Outlook forecast, which indicated that world output would increase 4.2% in 2011 from 2010. Advanced economies are expected to increase about 2.2%, but emerging and developing economies will likely expand 6.4%. Since then, the IMF, the Organization for Economic Cooperation and Deveopment (OECD), and other forecasting groups have become steadily more upbeat.

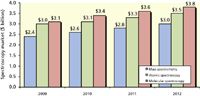

With these developments in mind, and after reviewing various industry data for 2010 and the prospects for 2011, Instrument Business Outlook (IBO), a publication of Strategic Directions International, Inc. (SDi, Los Angeles, California), a consulting and market intelligence firm specializing in this market, has estimated the total revenues for the worldwide market for analytical and life science instrumentation at almost $40 billion for 2010, an almost 7% increase from a depressed 2009. SDi now forecasts that the analytical and life science instrument industry will continue its upward expansion in 2011 at the rate of 5.6%. It is likely that industry revenue growth will be in the 5–7% range for the foreseeable future.

Interest in aftermarket products and services, including such items as consumables (especially chemicals), software updates, and accessories is very keen. As the installed base of instruments grows and the market matures, the aftermarket becomes especially important. In selected technology areas, the aftermarket is a very significant product segment, growing faster than instrument system revenues and often more profitable. For some technologies, instrument systems (hardware) actually may be declining in unit sales while the aftermarket provides at least minimal growth. It should be noted that all the revenue projections in this article include the total mix of revenue sources: instrument system sales, aftermarket, and service.

The Overall Spectroscopy Market

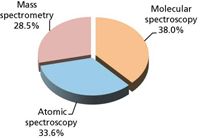

The spectroscopy market can be segmented into three distinct sectors: molecular spectroscopy, atomic spectroscopy, and mass spectrometry (MS). The applications of the techniques included in each sector and their prospects differ significantly, especially within each sector. Worldwide revenue for all spectroscopy segments is estimated at about $9.1 billion for 2010, or about 23% of the entire laboratory analytical and life science instrument market.

The overall spectroscopy market is estimated to have increased 7.4% in 2010, a substantial improvement over 2009, and a return to the norms of 2007 and 2008. SDi projects spectroscopy market growth in 2011 will be slightly less exuberant but still robust at a rate of 6.7%. As with other analytical techniques, the spectroscopy market was a beneficiary of the positive effects of a general return to global economic growth and government stimulus programs in many countries (especially in the United States, China, and the European Union) that gave a real boost to the instrumentation industry and which should continue in 2011. Likewise, various industrial markets such as metals, semiconductors, automotive production, and chemicals have been reinvigorated. Combined with continued growth from academia and government expenditures, the prospects look very good for 2011 and 2012.

Figure 1: 2010 spectroscopy market by sector ($9.1 billion).

Molecular spectroscopy techniques accounted for about 38% of the spectroscopy market in 2010, with several diverse techniques addressing a wide range of applications in almost every industry category. Atomic spectroscopy is the second largest sector at almost 34%, while MS accounts for over 28% of spectroscopy revenues. Please note that liquid chromatography (LC) and gas chromatography (GC) front-ends to mass spectrometers, and their associated aftermarket and service revenues, are not included in this analysis.

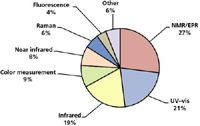

Figure 2: 2010 molecular spectroscopy market by technique.

Initial system sales (hardware) represented just over 70% of spectroscopy revenues in 2010. Aftermarket purchases of accessories, software, and consumables accounted for approximately 14% of revenues, which is less than other laboratory techniques, but still significant. Service revenues for service contracts, on-call service, and spare parts combined for about 15% of the total market.

Molecular Spectroscopy

In 2010, the global molecular spectroscopy market increased dramatically by almost 10% to over $3.4 billion, quite a turnaround from the decline in 2009. The pace of growth in demand for molecular spectroscopy will be far more moderate in 2011 following the healthy rebound that it experienced in 2010. As government stimulus spending, which had been a huge boon to academic and government demand for nuclear magnetic resonance (NMR), dwindles in 2011, the growth rate for NMR will be cut in half for the coming year, and will be one of the biggest reasons for the overall drop in the growth rate for molecular spectroscopy.

Color measurement techniques and ellipsometry will see much lower growth rates in 2011, primarily because of the very high growth rates both techniques experienced as they rebounded from sharp declines during the recession. Color measurement, which should see moderate single-digit growth, is not expected to exceed its market highs of a few years ago anytime soon. Ellipsometry, on the other hand, should continue its strong showing thanks to a cyclical upswing in the semiconductor and electronics industry. This coming year is expected to exhibit more typical annual growth across the board for molecular spectroscopy, with Raman outperforming all other molecular spectroscopy techniques at close to 10% growth. Although Raman is a much more established analytical technique than it was 5 or 10 years ago, it is far from being a mature technique.

Technological advances in such areas as micro electromechanical systems (MEMS), batteries, and optics have led to the development of a broad range of rugged, powerful, and highly effective handheld instruments. Handheld instrumentation will continue to be the driving force behind much of the increase in demand for molecular spectroscopy in 2011. Raman accounts for the heaviest proportion of demand for handheld and portable instruments, while growing in significance within the molecular spectroscopy market. The broad range of industries and applications over which molecular spectroscopy is used will also be a major benefit to overall demand, particularly in an economic environment where most industries are experiencing modest expansion.

Figure 3: 2010 atomic spectroscopy market by technique.

The UV–vis, polarimeter, and refractometer markets saw modest demand growth in 2010, but this will likely slow somewhat in 2011 as stocks have been replenished. Both of these markets consist of instruments that are generally lower in cost, most of which are under $10,000. As relatively small-ticket items, they were less of a consideration to end-users who had to cut capital budgets in 2009, so demand held up. Demand for microvolume UV–vis, which is mostly related to the biotechnology industry, will continue to see very strong double-digit growth, more than offsetting generally flat to declining segments of the UV–vis market, which include single-beam and visible-only instruments.

Figure 4: 2010 mass spectrometry market by technique.

Fluorescence instrumentation is also tied to the life science market, but standalone instruments continue to exhibit sluggish demand. This is primarily because of microplate readers that often include a fluorescence detection mode and offer productivity improvement potential for many applications. Nevertheless, standalone lifetime fluorescence instruments, which include both time-domain and frequency-domain techniques, are expected to expand steadily and lead the fluorescence market because they provide significantly more information than concentrated steady-static spectrofluorometers.

A very large number of suppliers are involved in the design, manufacture, and sale of molecular spectroscopy instrumentation. Overall market share position, however, tends to be a function of dominance in particular product segments. Bruker (Billerica, Massachusetts) will continue to lead the molecular spectroscopy vendor share by a considerable margin due to its extremely strong position in the large NMR market. Major acquisitions in 2010 have significantly reshaped the competitive landscape of the companies that trail Bruker. Thermo Scientific (Waltham, Massachusetts) is now a strong number two among molecular spectroscopy vendors because of its leading position in the UV–vis and infrared markets, while the company's acquisition of fast-growing Ahura Scientific in 2010 makes Thermo the leader in Raman spectroscopy as well. Agilent's (Santa Clara, California) acquisition of Varian now makes Agilent one of the three major NMR vendors, putting Agilent on par with PerkinElmer (Wellesley, Massachusetts) in terms of overall molecular spectroscopy vendor share. Foss's (Hillerod, Denmark) dominance in the near-infrared (NIR) market makes it one of the more significant competitors in the market, while X-Rite's (Grand Rapids, Michigan) strong rebound in the color analysis market gives it about 4% of the overall molecular spectroscopy market. It is interesting to note that four of the top 11 competitors in the molecular spectroscopy market are based in Japan, including Shimadzu (Kyoto, Japan), Jasco (Tokyo, Japan), Horiba (Kyoto, Japan), and JEOL (Tokyo, Japan). The top 10 molecular spectroscopy vendors, which also include Danaher (Washington, DC), should easily break the $100 million mark in revenues this coming year.

Atomic Spectroscopy

The total market for atomic spectroscopy is forecast to grow at 6.5% for 2011, reaching $3.25 billion. Although such growth is, historically speaking, quite high for this market, it will fall a bit short of last year's realized growth of 6.9%. Strongly buoyed by the improving global economy, last year's total outperformed our original expectation that the atomic spectroscopy market would grow 5.3% for 2010. Ongoing improvement in the end markets will continue to provide this positive effect on the atomic spectroscopy market in the coming year.

Figure 5: Spectroscopy market by product segment.

In terms of individual technologies, the strongest growth is expected in the X-ray diffraction (XRD) market. Industrial applications are broadening at the same time that these markets are gaining renewed strength. Additionally, the research market is particularly important for XRD, and the positive effect of stimulus funding should extend well into 2011 for high value research diffractometers. XRD growth for 2011 is estimated at more than 11%. X-ray fluorescence (XRF) is also expected to contribute strong growth of nearly 8%. As the largest individual technology segment, with 2010 revenues of nearly $850 million, the strong growth in XRF is one of the primary drivers for the overall growth in atomic spectroscopy. XRF has important quality control applications in the detection of hazardous elements in commercial goods, from electronics to children's toys. The slowdown in the global economy had a severe effect on the XRF market, but now that that situation has been ameliorated, XRF is again experiencing an expansion.

Figure 6: Estimated growth by spectroscopy sector for 2011.

After the X-ray technologies, the fastest-growing segments of the market are inductively coupled plasma–mass spectrometry (ICP-MS) and the sum parameter technologies, including total organic carbon (TOC) analysis as its most important component. Both ICP-MS and TOC have many environmental applications, including the monitoring of process and waste streams for composition and contamination. Among the slower-growing techniques are relatively well-established techniques such as atomic absorbance (AA) and ICP spectroscopy. These technologies have primarily environmental applications, which are characterized by steady, if not impressive, growth. Arc-spark spectroscopy, which is predominately used for metals analysis, will also see sluggish growth of less than 4% for 2011. Although the global growth for these three technologies is relatively poor, growth will be more considerable in developing countries in Asia, Eastern Europe, and Latin America.

Table I: Spectroscopy product growth prospects for 2011

The top five vendors make up just about half the market. Thermo Fisher Scientific maintains its leading position with 15% of the market. Thermo offers products in all of the individual segments, and holds a leading position in the sizable XRF market, partly because of its very successful 2005 acquisition of Niton, a maker of handheld XRF instruments. PerkinElmer, historically associated with AA, ICP, and ICP-MS, continues to hold leading positions in these markets, combining for an 11% share of the total market. Spectris (Surrey, United Kingdom), Rigaku (Tokyo, Japan), and Bruker are principally involved in XRF and XRD, the two largest individual technology markets. However, the completion of the acquisition of Varian Instruments by Agilent Technologies in May 2010 should result in a shift in the 2011 market share when Agilent records a full year's revenue from the Varian product lines in AA and ICP. Other important vendors include broad-based suppliers like Shimadzu, and more focused players like Leco (St. Joseph, Michigan), General Electric (Fairfield, Connecticut), Spectro Analytical (Ametek, Kleve, Germany), and Horiba.

Mass Spectrometry

In the aftermath of a difficult 2009 for MS, something the various suppliers were unaccustomed to, 2010 proved to be the turnaround for which the industry hoped. MS revenues expanded almost 10% in 2010, more than making up for the 3% decline in 2009. Governmental stimulus funding and a pent-up demand for new MS products were especially instrumental in this turnaround. Improved overall economic conditions should maintain this upward momentum.

Demand for MS, which demonstrated robustness during the recession, is expected to maintain consistent high single-digit growth in 2011. In fact, MS is expected to be the fastest growing segment of the entire analytical and life science instrument market with a projected growth rate of 8.5% for 2011. The continuing pipeline of new product introductions is helping to drive many segments of the MS market forward. All of the industries that contribute significant demand for MS are expected to see at least modestly positive growth this coming year. The competitive landscape also looks significantly different now than at the beginning of 2010.

Every year seems to bring yet another generation of new instruments that supersede the previous year's products, which helps generate demand from leading-edge researchers. However, many end-users do not benefit greatly from these latest-generation systems because their application requirements can be addressed using established products, with some laboratories purchasing used or refurbished instruments. Of all the segments of the mass spectrometry market, Fourier transform (FT)-MS continues to be the most dynamic, with Thermo Scientific introducing additional new FT-MS–based models targeted at a much broader customer base.

The fastest growing segments of the mass spectrometry market will continue to be the time-of-flight (TOF) LC–MS market, which includes quadrupole (Q)-TOF and LC-TOF, and the FT-MS market, both of which are expected to see consistent double-digit growth for the foreseeable future. These two markets generally consist of the highest performance and most expensive of all mass spectrometers, and they have seen numerous new instrument introductions that rapidly make currently installed models obsolete.

The mainstay of the MS market is the tandem LC–MS segment, which includes triple-quadrupole and ion-trap LC–MS. It accounts for more than one-third of the overall MS market and is expected to increase in revenue by more than 8% in 2011. Market share positions of the major suppliers have also shifted somewhat based on new product introductions and marketing initiatives.

Much of the MS market has benefited from stimulus spending programs that have made academic and government labs flush with funding to purchase the latest generation, highest performance analysis instruments. However, this surge of funding that helped maintain MS demand during the recession is now trailing off, and it will be a challenge for academic and government laboratories to significantly increase their budgets for MS and other high end instruments in 2011.

Although growth in academia and government will not be as spectacular as in 2010, demand from the life science industries should see considerably better growth this year than last. Although demand from the larger biopharmaceutical firms was not as heavily impacted as smaller companies, their confidence in the economy is gradually improving, which will mean more investment in R&D in 2011, and therefore more orders for mass spectrometers. Smaller pharmaceutical and biopharmaceutical firms have had more difficulty accessing credit and financing to pursue their projects, but with improvement, there will surely be a significantly higher rate of growth in demand.

Accelerated research programs into the study of diseases, and the drugs to treat them, will lead to higher demand from contract research organizations (CROs) for MS as well, particularly for higher end and more costly systems. In addition, the evolution of food safety testing is increasingly relying on MS-based methods, while modern environmental regulations are being adopted by developing nations such as China, which is also supporting demand for more basic mass spectrometers, such as those used in GC–MS.

Two major business combinations were completed in 2010 that further consolidated the MS market. Agilent finally completed its pending acquisition of Varian, which also required the divestiture of some of Varian's MS businesses to Bruker. While greatly expanding Agilent's MS business, making Agilent the clear number two vendor in the market, it also makes Bruker a major competitor in non-life science MS. The other major development of 2010 was Danaher's acquisition of MDS Analytical Technologies and the Applied Biosystems/MDS Sciex joint venture, which united two closely related businesses under the AB Sciex name.

Industry consolidation and heightened competition during the last few years has concentrated market shares with five firms now accounting for over 80% of the mass spectrometry market. AB Sciex (Foster City, California) is the market leader with renewed vitality under its new corporate parent, Danaher Corporation. The other major MS vendors include Thermo Fisher Scientific, Agilent Technologies, Waters (Milford, Massachusetts), and Bruker, all of which offer a number of MS techniques. Although not as broad-based, suppliers such as Shimadzu in matrix-assisted laser desorption-ionization (MALDI)-TOF, Leco in GC–TOF and LC–TOF, and JEOL in magnetic sector technology, maintain important positions in their respective areas of emphasis.

Spectroscopy: A Balanced Set of Complementary Technologies

Molecular and atomic spectroscopy instruments utilize various portions of the electromagnetic spectrum as a means to analyze compounds and elements of different types. MS converts molecules into ions that are separated according to their mass-to-charge ratio, and the abundance of each ion is measured and displayed as spectra. Each technology is fairly different, but many analytical applications can be addressed with instruments from several categories. For instance, structural analysis can be done with NMR, XRD, and MS. Likewise, water analysis can be accomplished with an ICP, ICP-MS, or UV–vis instrument. It just depends on whether one is looking to identify molecules or elements, and the degree of sensitivity and speed of analysis that is required.

The various types of instrumental techniques all address different analysis challenges and collectively represent a set of solutions available to the scientist. And while many instruments compete with another, invariably a particular instrument does the job better than others. This diversity and scope contributes to spectroscopy's continued importance and presence in laboratories around the world. But this diversity has also minimized its vulnerability to sectors of the economy most affected during economic downturns, as the various techniques address applications in areas somewhat separate from the overall economy.

Atomic spectroscopy techniques are most closely associated with environmental applications and the analysis of metals and minerals. The slowdown in the global economy significantly impacted spectroscopy, but as the economy improved, the rebound was dramatic. Water quality issues still drive demand for ICP-MS and TOC and provide some support to the more mature AA and ICP markets. XRD continues to be an important technique for the analysis of powders and crystals and is indispensible in drug development efforts. During 2010, and continuing today, the metals and semiconductor industries are once again driving demand for techniques like arc-spark and XRF instrumentation.

New and more-demanding applications have also found spectroscopy techniques to be convenient solutions for analytical challenges, especially when developed for the users in more usable configurations and with superior performance capabilities. Handheld and portable instruments help to bring analytical techniques to the sample and not the other way around. As a result, field analysis has become a more viable approach, which is invaluable to scientists and technicians endeavoring to identify hazardous substances in water, soil, clothing, and food. Spectroscopy technologies are sweeping the market for security and defense, drug identification, food inspection, and environmental monitoring.

China, India, other Asia-Pacific nations, and Latin America represent the current and future growth for spectroscopy instrumentation. Although advanced nations such as the United States, Canada, and European countries remain important and growing markets, application requirements and economics differ substantially and suppliers will need to continue to innovate to properly address these opportunities.

Yet innovation is a given. Assuming the trends continue, instrument manufacturers will surely bring forth new products that will dazzle customers and help them solve problems easier, faster, and with more efficiency. Such innovation is the best guarantee of continued market success.

Lawrence S. Schmid is President and Chief Executive Officer, of Strategic Directions International, Inc., Los Angeles, California.

High-Speed Laser MS for Precise, Prep-Free Environmental Particle Tracking

April 21st 2025Scientists at Oak Ridge National Laboratory have demonstrated that a fast, laser-based mass spectrometry method—LA-ICP-TOF-MS—can accurately detect and identify airborne environmental particles, including toxic metal particles like ruthenium, without the need for complex sample preparation. The work offers a breakthrough in rapid, high-resolution analysis of environmental pollutants.

The Fundamental Role of Advanced Hyphenated Techniques in Lithium-Ion Battery Research

December 4th 2024Spectroscopy spoke with Uwe Karst, a full professor at the University of Münster in the Institute of Inorganic and Analytical Chemistry, to discuss his research on hyphenated analytical techniques in battery research.

Mass Spectrometry for Forensic Analysis: An Interview with Glen Jackson

November 27th 2024As part of “The Future of Forensic Analysis” content series, Spectroscopy sat down with Glen P. Jackson of West Virginia University to talk about the historical development of mass spectrometry in forensic analysis.

Detecting Cancer Biomarkers in Canines: An Interview with Landulfo Silveira Jr.

November 5th 2024Spectroscopy sat down with Landulfo Silveira Jr. of Universidade Anhembi Morumbi-UAM and Center for Innovation, Technology and Education-CITÉ (São Paulo, Brazil) to talk about his team’s latest research using Raman spectroscopy to detect biomarkers of cancer in canine sera.