Spectroscopy Market Profile: Benchtop NMR

Over the past decade, benchtop nuclear magnetic resonance instruments have been used in the petroleum and petrochemical industries for process control applications.

Over the past decade, benchtop nuclear magnetic resonance (NMR) instruments have been used in the petroleum and petrochemical industries for process control applications. Increased use of the technology in the pharmaceutical, agriculture, and food industries during the last few years has prompted a surge in growth in the market for benchtop NMR systems.

Benchtop NMR instruments are low-field, fixed-magnet systems operating at less than 100 MHz. Common ommercially available benchtop NMR models will employ magnets that operate at 42, 60, and 82 MHz and deliver sufficient resolution for quality control applications and reaction monitoring.

The convenience of having a benchtop NMR system in the laboratory has been a major influence in the growth of the market, particularly in the pharmaceutical industry. Instead of sending out samples to a core facility and waiting hours for results, pharmaceutical scientists are able to get NMR data almost immediately.

Because the instruments use fixed magnets, unlike with highfield systems, there is no need for cryogens such as liquid helium or liquid nitrogen. As a result, benchtop NMR instruments have a comparatively low overall cost of ownership.

Food laboratories are adopting benchtop NMR systems to determine solid fat content. Other applications include analyzing foods for moisture, carbohydrates, and alcohol content as well as food authenticity or adulteration.

The overall market for low-field and fixed-magnet NMR instruments totaled about $130 million in 2016. The demand for benchtop NMR systems continues to strengthen, particularly in pharmaceutical quality control applications and the food sector, in which NMR is used to analyze essential oils, fish oils, alcoholic beverages, and fruit juices. Leading suppliers of benchtop instruments include Bruker, with its minispec TD-NMR instruments, Thermo Fisher Scientific, which entered the market with its acquisition of picoSpin in 2012, Magritek, which recently introduced the Spinsolve 80, and Oxford Instruments, which offers the Pulsar NMR instruments.

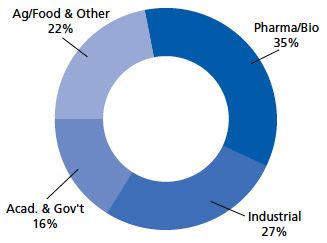

2016 benchtop NMR demand by sector.

Market size and growth estimates were adopted from TDA’s Industry Data, a database of market profiles from independent market research firm Top-Down Analytics. For more information, contact Glenn Cudiamat, general manager, at (888) 953-5655 or glenn.cudiamat@tdaresearch.com. Glenn is a market research expert who has been covering the analytical instrumentation industry for nearly two decades.

Market Profile: Mass, Molecular, and Atomic Spectroscopy

December 1st 2018Mass spectrometry, molecular and atomic spectroscopy technologies combine to represent more than a fifth of the overall market for laboratory analytical instrumentation. These techniques are perhaps the most broadly used instruments, with utility in pharmaceuticals and other life sciences, chemicals, environmental, food, clinical/Dx and other applications.