Market Profile: Process Raman Spectroscopy

Market Profile: Process Raman Spectroscopy

Although often considered to be one of several complementary molecular spectroscopy techniques, Raman spectroscopy offers a number of advantages that make it attractive for certain process applications. As with laboratory Raman spectroscopy, technological advancements have made Raman an effective tool for on-line analysis. Despite some recent contraction in demand, process Raman spectroscopy is still a sizeable market with solid prospects for growth.

Raman is often considered to be a complementary technique to infrared and near infrared (NIR) spectroscopy because the techniques can detect differing types of molecular vibrations and bonds. However, Raman spectroscopy generally provides very sharp chemical resolution as well as a linear response to molecular concentration. NIR, in contrast, has many overtones, and can produce much broader spectral bands, making it much harder to model and transfer NIR methods than when using Raman. In addition, interference from water is not an issue for Raman, while it is a major issue for infrared spectroscopy.

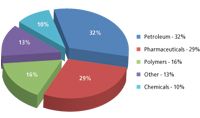

Process Raman spectroscopy - 2012.

Although Raman spectroscopy, in theory, has long held strong potential to be a very useful analytical technique, it was technologically challenging or impossible to effectively implement in a commercial system, either in the laboratory or on-line. However, improvements in optics, lasers, and other areas over the past two decades have allowed for the development of reliable Raman spectrometers that can multiplex numerous sampling locations that can be tethered via fiber optics from dozens or even hundreds of feet away.

Raman spectroscopy has received much attention for process applications in the pharmaceutical industry, including PAT, but also faces competition from myriad other process analytical techniques that have limited growth in demand from that sector. The oil and gas industry is where process Raman is most established, and it is a sector with money to spend. Demand for process Raman spectroscopy declined slightly in 2012 to a little more than $20 million, but it should see a gradual return to a solid growth rate over the next 18 months.

The foregoing data are based on research conducted for SDi's Market Analysis and Perspectives (MAP) report program. For more information, contact Stuart Press, Vice President, Strategic Directions International, Inc., 6242 Westchester Parkway, Suite 100, Los Angeles, CA 90045, (310) 641-4982, fax: (310) 641-8851, www.strategic-directions.com.

Market Profile: Mass, Molecular, and Atomic Spectroscopy

December 1st 2018Mass spectrometry, molecular and atomic spectroscopy technologies combine to represent more than a fifth of the overall market for laboratory analytical instrumentation. These techniques are perhaps the most broadly used instruments, with utility in pharmaceuticals and other life sciences, chemicals, environmental, food, clinical/Dx and other applications.