Bright Outlook for Continued Spectroscopy Market Growth

Techniques with the highest growth prospects include Fourier-transform ion cyclotron resonance mass spectrometry, portable mass spectrometry, and X-ray diffraction.

Following an outstanding year in 2011, the landscape looks promising for a continuation of strong sales of spectroscopy instruments, albeit at a slightly lower level. As usual, mass spectrometry will be the pacesetter, followed closely by atomic spectroscopy. Molecular spectroscopy will likely cool off somewhat as the result of played out stimulus programs, especially for nuclear magnetic resonance spectroscopy.

In 2011, laboratories continued to purchase new instrument systems, due in part to latent demand and the availability of higher performance systems. Many instrument suppliers have stimulated demand through the introduction of well-designed, better performing instruments, some with more attractive pricing. In addition, aftermarket purchases of chemicals and other consumables as well as software and various detectors experienced strong demand as testing requirements increased both in volume and for new procedures. This was particularly true for academic and government laboratories, but also for general industry, electronics, pharmaceuticals, and biotech. Demand was very strong in emerging markets, especially China, India, and Latin America, but also in North America, some of which was the result of governmental stimulus programs. European growth was less exuberant because of austerity programs and reduced economic activity, while Japan suffered because of the earthquake and tsunami.

Spectroscopy is a key sector of the analytical and life science instrument industry. For many years, the instrument industry in general and the spectroscopy segment in particular have proven quite resilient while serving the scientific requirements for a vast array of applications in every conceivable industry. Growth has been fairly steady for the last decade, averaging around 6% annually. Compared to the double-digit growth seen in the 1980s and 1990s, our industry is expanding at a lower, but fairly stable rate.

The broader economic situation last year did not seem very robust to most observers, and the outlook for this year seems a bit on the downside. In January 2012, the International Monetary Fund (IMF) issued a warning on the debt crisis and cut its global forecast. It predicted that the global economy would expand only 3.3% in 2012, down from 3.8% last year, even though as recently as September 2011 the IMF had forecasted global growth at 4%. The IMF further suggested that Europe would likely experience at least a mild recession, and inaction on Euro-zone borrowing costs could worsen the situation. Although developing economies will slow slightly, they will still outpace advanced economies including the United States, Japan, the United Kingdom, and the Euro zone, which collectively may only expand at a rate of 1.5%. Fortunately, our industry is not overly impacted by macroeconomic developments, unless they are very severe (as happened in 2009). The continuing demands of the life science marketplace, environmental concerns, the search for new materials, and security and defense concerns are important driving forces that tend to outweigh general economic trends.

With these developments in mind, and after reviewing various industry data for 2011 and the prospects for 2012, Instrument Business Outlook (IBO), a publication of Strategic Directions International, Inc. (SDi), a consulting and market intelligence firm specializing in this market, has estimated the total worldwide market for analytical and life-science instrumentation revenues at over $44 billion for 2011, an increase of over 7% from 2010, a year that also experienced a strong growth spurt from a depressed 2009. SDi now forecasts that the analytical and life-science instrument industry will continue its upward expansion in 2012 at a somewhat lower, but respectable rate of 5.5%. It is likely that the overall analytical and life-science instrument industry revenue growth will be in the range of 5–7% for the foreseeable future.

Interest in aftermarket products and services, including items such as consumables (especially chemicals), software updates, and accessories is very keen. As the installed base of instruments grows and the market matures, the aftermarket becomes especially important. In fact, in selected technology areas, the aftermarket is a very significant segment that is growing faster than instrument system revenues and often is more profitable. It is also true that for some technologies, instrument systems (hardware) may actually be declining in unit sales while the aftermarket provides at least minimal growth. So it should be noted that all the revenue projections in this article include the total mix of revenue sources: instrument system sales, aftermarket, and service.

The Overall Spectroscopy Market

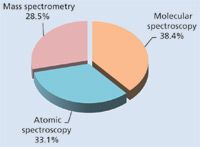

The spectroscopy market can be segmented into three distinct sectors: molecular spectroscopy, atomic spectroscopy, and mass spectrometry (MS) (Figure 1). The applications of the techniques included in each sector and their prospects differ significantly, especially within each sector. Worldwide revenues for all spectroscopy segments is estimated at about $10 billion for 2011, or about 24% of the entire laboratory analytical and life science instrument market.

Figure 1: 2011 spectroscopy market by sector ($10 billion).

The overall spectroscopy market is estimated to have increased 7.7% in 2011, a substantial performance given the economic uncertainty that existed throughout the year. SDi projects that spectroscopy market growth in 2012 will be slightly less exuberant, but still robust at a rate of 6.2%, with the fastest-growing techniques hitting growth rates as high as 10–11%, and the slowest at 1–2% (Table I). As with other analytical techniques, the spectroscopy market was a beneficiary of the positive effects of a general return to global economic growth and the last effects of government stimulus programs in several countries, especially in the United States, China, and Germany, which gave a real boost to the instrumentation industry. However, positive exogenous factors will be somewhat less significant in 2012. Nevertheless, improving conditions in various industrial markets such as metals, automotive production, and chemicals will continue to be important to the growth of the spectroscopy market in 2012 as they did in 2011. Unfortunately, slower growth in academia and government sectors will be the primary reason for slower growth in 2012.

Molecular spectroscopy techniques accounted for over 38% of the spectroscopy market in 2011, with several diverse techniques represented that address a wide range of applications in almost every industry category. Atomic spectroscopy is the second largest sector at over 33%, while mass spectrometry accounts for well over 28% of spectroscopy revenues. (Please note that liquid chromatography [LC] and gas chromatography [GC] front-ends to mass spectrometers, and their associated aftermarket and service revenues, are not included in this analysis.)

Initial system sales (hardware) represented about 70% of spectroscopy revenues in 2011. Aftermarket purchases of accessories, software, and consumables accounted for approximately 16% of revenues, which is less than for other laboratory techniques but still significant. Service revenues for service contracts, on-call service, and spare parts combined for about 14% of the total market.

Molecular Spectroscopy

The molecular spectroscopy market is not completely immune to the effects of a slowly growing economy, and accordingly it should see its pace of growth drop from more than 7% in 2011 to less than 5% in 2012 (Figure 2). All segments of the molecular spectroscopy market will see a decline in their pace of growth, although some more than others. However, every technology segment is still expected to see at least modest growth in demand in the year ahead. The continued expansion and acceptance of handheld instruments in a number of segments of the market will continue to be a primary driver of growth.

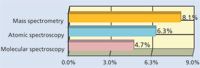

Figure 2: Estimated growth by spectroscopy sector for 2012.

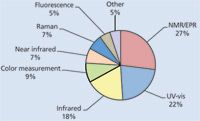

Nuclear magnetic resonance (NMR) is the largest segment of the molecular spectroscopy market and accounted for more than a quarter of its $3.8 billion in demand in 2011 (Figure 3). However, it will experience a fairly large decline in its pace of growth, from more than 9% in 2011 to the mid-single-digits in 2012. Stimulus spending programs that were enacted in response to the "Great Recession," which helped to considerably bolster demand for NMR systems in academic and government laboratories, have now mostly run their course. This stimulus effect on the NMR market trailed most other technology sectors because of the long lead time associated with such instruments, often as long as 18 months.

Figure 3: 2011 molecular spectroscopy market by technique ($3.8 billion total).

The colorimetry market has seen some particularly sharp changes to the direction of the market over the last few years, including a steep decline in demand in 2009 followed by an even sharper rebound in 2010. For 2011, the roller coaster ride appears to be over, at least for now, as demand has softened and is expected to grow at a fairly typical low-single-digit rate in 2012.

The decline in the annual growth rates for the infrared (IR) and near-infrared (NIR) segments of the market will be fairly minimal, while Raman will continue to see the strongest performance of any molecular spectroscopy segment. The run up in the value of petroleum once again leaves the oil industry with more money than it knows what to do with, which combined with the growing focus on alternative fuels, will drive fairly strong growth in the chemicals, oil and gas, and related industries, all of which contribute to considerable demand for vibrational spectroscopy techniques. Regulation and the steady drive to increase food safety will also be a major contributor to maintaining near 5% growth in NIR demand in 2012.

Handheld molecular spectroscopy instruments have exploded onto the market over the past decade. Much of the demand for such instruments has been related to security and military applications, most of which is driven by government spending. Looming cutbacks in government spending at all levels may put a damper on the growth in demand for such portable instruments, but they will still see significantly stronger growth than the overall average for molecular spectroscopy in 2012 as the advantages of handheld instrumentation spread to other fields.

Major merger and acquisition activity in the molecular spectroscopy market was fairly sedate in 2011, with the most significant activity being the spin-off of the water business of ITT (White Plains, New York) into the new Xylem organization (White Plains, New York). The company's water analysis business has been growing quite rapidly through acquisitions, and the company is on the verge of becoming one of the top 10 competitors in the UV–vis sector as a function of its significant involvement in photometry, test kits, and spectrophotometers.

A very large number of suppliers are involved in the design, manufacture, and sale of molecular spectroscopy instrumentation. Overall market share position, however, tends to be a function of dominance in particular product segments. Bruker (Billerica, Massachusetts) will continue to lead the molecular spectroscopy vendor share by a considerable margin as a result of its extremely strong position in the large NMR market coupled with its important role in IR spectroscopy. Thermo Fisher Scientific (Waltham, Massachusetts) is a strong number two among molecular spectroscopy vendors because of its leading position in the UV–vis and IR markets, as well as its growing position in Raman spectroscopy. Agilent's (Santa Clara, California) acquisition of Varian in 2010 made Agilent one of the three major NMR vendors and propelled it ahead of PerkinElmer (Waltham, Massachusetts) in terms of overall molecular spectroscopy vendor share. PerkinElmer remains a potent supplier of a variety of molecular spectroscopy instruments, especially UV–vis and IR-based instruments. FOSS's (Laurel, Maryland) dominance in NIR makes it one of the more significant competitors, and X-Rite's (Grand Rapids, Michigan) strong rebound in the color analysis market gives it about 4% of the overall molecular spectroscopy market as well. Other important molecular spectroscopy suppliers include Shimadzu, JASCO, Horiba, and JEOL, all headquartered in Japan. Danaher (Washinton, DC), with its strong role in water analysis–related instruments, completes the roster of top 10 molecular spectroscopy vendors, all of which now have annual revenues in this field in excess of $100 million.

Atomic Spectroscopy

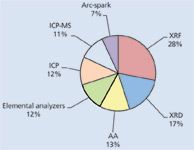

Spectroscopy is a general method for using a signal, generally based on a portion of the electromagnetic spectrum, to identify samples. In the case of atomic spectroscopy, the information from the instrument typically provides the elemental composition of the sample. Depending on the particular technique, atomic spectroscopy instruments can measure elemental abundances in the percent range down to trace quantities at the level of parts per trillion or even parts per quadrillion. The total market demand for atomic spectroscopy expanded almost 8% over 2010, reaching $3.3 billion in 2011. This market is forecasted to grow at 6.3% for 2012 (Figure 2), to reach $3.5 billion.

Figure 4: 2011 atomic spectroscopy market by technique ($3.3 billion total).

The two largest product segments in atomic spectroscopy are both based on electromagnetic radiation in the X-ray portion of the spectrum (Figure 4). X-ray fluorescence (XRF) and X-ray diffraction (XRD) combine to form nearly half of the total market for atomic spectroscopy. These techniques continue to post stronger growth than the rest of the techniques covered in this segment. XRF, the larger of the two, is forecast to achieve growth of 8.6% in the coming year, propelled by its continued expansion from its historical application areas in metal analysis into the broader testing of consumer products for regulated hazardous substances, such as lead in children's toys and clothing.

Technological advances, such as XRF instruments that come in an easy-to-use handheld format, have also helped to expand the market demand out of the laboratory and into field applications. These trends are continuing to support growth in the XRF market. XRD is forecast to achieve the greatest growth among atomic spectroscopy techniques over the coming year, at nearly 10%. Rather than investigating the elemental composition of samples, the primary application of XRD is to use the diffraction of X-rays from the crystal structure in a sample to identify molecular compounds. The technique is highly research-oriented and has strong life science and drug development applications, where it is used to examine proteins and other structures. These application areas contribute to the stronger growth of XRD compared to other atomic spectroscopy techniques.

More-traditional areas of atomic spectroscopy, such as atomic absorbance (AA), inductively coupled plasma (ICP), and ICP coupled with mass spectrometry (ICP-MS) are more associated with environmental testing applications. After the X-ray technologies, these three techniques are the three largest product segments. Growth is typically more moderate, with AA (the longest established market) forecast to grow the least. ICP-MS, the only technique dependent on MS rather than some form of light spectroscopy, should have better prospects. Of the remaining techniques, arc/spark optical emission spectroscopy (used primarily for metals analysis) will see the least growth for 2012, gaining 3.6%. The other techniques include various elemental analyzers that provide determinations of specific elements rather than a complete elemental analysis of the sample. Growth for these techniques is forecast to range from 4 to 7%.

The top vendors for atomic spectroscopy continue to remain relatively stable. Thermo Fisher Scientific tops the list, with about 15% of the market, a broad product portfolio, and dominance in the important handheld XRF market. PerkinElmer's historical strength in AA, ICP, and ICP-MS continues to capture the second position for the company. The next three largest vendors, PANalytical (part of Spectris, Surrey, UK), Rigaku (Tokyo, Japan) and Bruker are focused primarily on X-ray technologies, although Bruker has broadened its portfolio through a number of acquisitions in recent years. Agilent Technologies is close behind, with its ICP-MS business augmented by the additions of AA and ICP from the Varian acquisition in 2010. Other important vendors include broad-based suppliers such as Shimadzu, and more-focused players such as LECO (St. Joseph, Michigan), General Electric (Uppsala, Sweden), Spectro Analytical (Ametek, Kleve, Germany), and Horiba.

Mass Spectrometry

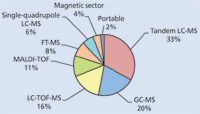

Despite a variety of negative macroeconomic factors that are expected to continue well into 2012, demand for MS is still expected to see high single-digit growth for the year (Figure 2), which is only modestly lower than the pace in 2011. The large installed bases combined with continued improvements in performance are the major factors helping to drive such robust growth. Unlike 2010, in which there was major consolidation in the MS market, there was little in the way of merger and acquisition activity in 2011. The MS market is predicted to grow slightly over 8% in 2012 (Figure 2), only a bit slower than its 9% growth in 2011, and approach $3.1 billion in revenues (Figure 5).

Figure 5: Spectroscopy market by product segment ($ billion).

The GC–MS sector has shown somewhat surprising strength, growing by more than 8% in 2011, and is expected to see at least 7% growth in 2012. Although single-quadrupole GC–MS, which accounts for the majority of the market (Figure 6), along with ion-trap GC–MS, are expected to see more moderate annual growth, triple-quadrupole GC–MS has rapidly become a major segment of the market. As triple-quadrupole GC–MS gains broader acceptance, it will see strong double-digit growth, helping to drive the overall GC–MS sector. Time-of-flight-GC–MS (TOF-GC–MS) growth is also beginning to accelerate, largely as a result of Agilent's introduction of the first ever dedicated quadrupole time-of-flight (QTOF)-GC–MS system, and the expected introduction of a TOF-GC–MS instrument in the near future. The entry of the dominant leader in GC–MS into the TOF segment clearly validates the technique, which should now see rapid growth resulting in TOF-GC–MS becoming a more significant technique in the GC–MS market.

Figure 6: 2011 mass spectrometry market by technique ($2.8 billion total).

The pace of growth for Fourier-transform ion cyclotron resonance MS (FT-MS) fell into the high single digits in 2011 as a result of the discontinuation of the former Varian product line under Agilent, which now leaves only two major competitors in the market. However, both Bruker and Thermo Fisher Scientific have continued to push ahead rapidly in development of their respective FT-MS systems. The continued innovation of both vendors will help to return the FT–MS market to double-digit growth in 2012 and beyond (Table I).

Table I: Spectroscopy product growth prospects for 2012

Technological improvements have been rolling along particularly well in market segments such as QTOF and triple-quadrupole LC–MS. The main focus of recent design improvements has been in the area of ion optics, with variations of ion mobility technology being developed by nearly all major vendors. These improvements have led to yet another order of magnitude increase in sensitivity and other performance factors. Such improvements will help to continue to drive high single-digit growth in the tandem LC–MS and LC–TOF-MS markets.

Portable MS has begun to develop into a major segment of the market in recent years as a result of technological advances allowing for miniaturization and ruggedization, combined with strong growth in demand for security-related instrumentation. A large portion of demand for portable MS relies on various levels of spending by the government, including the military. Despite major cutbacks in government spending, which has affected the pace of growth of portable MS, this area is still expected to hit double-digit growth in 2012 and beyond (Table I).

Demand for matrix-assisted laser desportion–ionization-TOF (MALDI-TOF) systems surged in 2010 and into early 2011, driven in part by a handful of new instrument introductions. Most recent introductions have focused on TOF-TOF and linear configurations, which should help to drive high single-digit or double-digit growth in 2012, while growth in demand for reflectron MALDI-TOF instruments will be much less vibrant. The result should be growth of 6–7% for the overall MALDI-TOF market in 2012.

Industry consolidation and heightened competition during the past few years has concentrated market shares, and five firms now account for more than 80% of the MS market. AB Sciex (Framingham, Massachusetts) is the market leader, with renewed vitality under its new corporate parent, Danaher Corporation. The other major MS vendors include Thermo Fisher Scientific, Agilent Technologies, Waters (Milford, Massachusetts) and Bruker, all of which offer a number of MS techniques. Although not as broad-based, suppliers such as Shimadzu in MALDI-TOF, LECO in GC–TOF and LC–TOF, and JEOL in magnetic sector technology maintain important positions in their respective areas of emphasis.

Spectroscopy: A Technology Still Addressing Analytical Challenges

Most basic spectroscopy techniques were developed and introduced many decades ago. Yet today, the various types of spectroscopy instruments previously described in this article are more popular than ever. Of course, yesteryear's instruments are hardly comparable to today's spectroscopy instrumentation in terms of detection limits, dynamic range, speed of analysis, and the ratio of price to performance. Molecular and atomic spectroscopy instruments use various portions of the electromagnetic spectrum as a means to analyze compounds and elements of different types. MS converts molecules into ions that are separated according to their mass-to-charge ratio and the abundance of each ion is measured and displayed as spectra. So each technology is fairly different, yet many analytical applications can be addressed with instruments from several categories. For instance, structural analysis can be done with NMR, XRD, and MS. Likewise, water analysis can be accomplished with an ICP, ICP-MS, or UV–vis instrument. It just depends on whether one is looking to identify molecules or elements, and the degree of sensitivity and speed of analysis required.

The various types of instrumental techniques all address different analysis challenges and collectively represent a set of solutions available to the scientist. And although many instruments compete with another, invariably a particular instrument does the job better than others. So this diversity and scope contributes to spectroscopy's continued importance and presence in laboratories around the world. But this diversity has also minimized its vulnerability to economic downturns in particular sectors, because the various techniques address applications in areas somewhat separate from the overall economy.

Atomic spectroscopy techniques are most closely associated with environmental applications and the analysis of metals and minerals. The slowdown in the global economy significantly affected atomic spectroscopy, but as the economy improved, the rebound was dramatic. Water quality issues still drive demand for ICP-MS and total organic carbon (TOC) analyzers and provide some support to the more mature AA and ICP markets. Likewise, XRD continues to be an important technique for the analysis of powders and crystals and is indispensable in drug development efforts. During 2010 and still today, the metals and semiconductor industries are once again driving demand for techniques like arc/spark and XRF.

Spectroscopy techniques also have been found to be convenient solutions for analytical challenges in new and more demanding applications, especially when instruments are developed to have more usable configurations and superior performance capabilities. Handheld and portable instruments help to bring analytical techniques to the sample and not the other way around. As a result, field analysis has become a more viable approach, and this is invaluable to scientists and technicians endeavoring to identify hazardous substances in water, soil, clothing, and food. Likewise, spectroscopy technologies are sweeping the market in areas such as security and defense, drug identification, food inspection, and environmental monitoring.

China, India, other Asia Pacific nations, and Latin America represent the current and future growth regions for spectroscopy instrumentation. Although the advanced nations like the United States, Europe, and Japan remain important and growing markets, application requirements and economics differ substantially and suppliers will need to continue to innovate appropriately to address these opportunities.

Innovation in the spectroscopy arena is alive and well. One only needs to visit important international exhibitions like Pittcon, Analytica, and the JAIMA show in Japan to appreciate the scope and extent of new and improved spectroscopy technology. The innovation comes from a push–pull effect between instrument companies and scientists that typically results in the development of instruments that meet the needs of the scientific community. As long as this continues, we can expect the spectroscopy market to remain vibrant and a worthwhile endeavor for everyone who makes and uses this technology.

Lawrence S. Schmid is president and chief executive officer of Strategic Directions International, Inc., in Los Angeles, California. Please direct correspondence to: sdi@strategic-directions.com.

LIBS Illuminates the Hidden Health Risks of Indoor Welding and Soldering

April 23rd 2025A new dual-spectroscopy approach reveals real-time pollution threats in indoor workspaces. Chinese researchers have pioneered the use of laser-induced breakdown spectroscopy (LIBS) and aerosol mass spectrometry to uncover and monitor harmful heavy metal and dust emissions from soldering and welding in real-time. These complementary tools offer a fast, accurate means to evaluate air quality threats in industrial and indoor environments—where people spend most of their time.

NIR Spectroscopy Explored as Sustainable Approach to Detecting Bovine Mastitis

April 23rd 2025A new study published in Applied Food Research demonstrates that near-infrared spectroscopy (NIRS) can effectively detect subclinical bovine mastitis in milk, offering a fast, non-invasive method to guide targeted antibiotic treatment and support sustainable dairy practices.