Spectroscopy Bounces Back

The spectroscopy market and its major segments, atomic and molecular spectroscopy and mass spectrometry, is analyzed and forecasted for 2010.

Spectroscopy-based instrumentation is an important sector of the analytical and life science instrument industry. Over the years, the overall industry, and spectroscopy in particular, have proven to be very resilient businesses, servicing the scientific requirements of a vast array of applications in every conceivable industry. Growth has been fairly steady for the last decade, averaging approximately 6% each year until recently. Compared to the double-digit growth seen during the 1980s and 1990s, most would agree that our industry is both mature and stable.

The demands of the life science marketplace, environmental concerns, the search for new materials, and security and defense concerns are important driving forces. The regional focus has now shifted to developing countries, especially in Asia where growth far outpaces that of North America, Europe, and Japan. But even as application requirements evolve and markets ebb and flow, 2009 proved to be a major challenge for every industry, including the laboratory instrument industry, and indeed, the spectroscopy segment as well. The global economic recession of the last 18 months was the worst the world has seen since the Great Depression of the 1930s. Fortunately, the bad economics news appears to be ebbing in terms of global economic development, although unemployment statistics are quite glum and will likely stay so for most of 2010. Unprecedented government intervention, in the form of expansionary fiscal and monetary policies and economic stimulus programs, has provided the basis for a renewal of global economic growth.

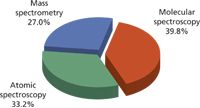

Figure 1: 2009 spectroscopy market by sector ($8.5 billion).

With these developments in mind, and after reviewing various industry data for 2009 and the prospects for 2010, Instrument Business Outlook (IBO), a publication of Strategic Directions International, Inc. (SDi), a consulting and market intelligence firm specializing in this market, has estimated the total worldwide market for analytical and life science instrumentation revenues at slightly under $37 billion for 2009. This represents an unusual decrease in instrument industry revenues of 3.0% from 2008, a result not seen since the early 1980s. SDi now forecasts that the analytical and life science instrument industry will rebound in 2010 and will expand at the rate of 5.2%. While not particularly exciting, it is a level of expansion that would be very welcome in many sectors of the global economy. Furthermore, 2011 is expected to return to the more familiar growth rate of about 6.5%. So the future looks immeasurably better.

Although one could assume that an economic recession might not be the best time to become acquisitive, 2009 certainly saw an increase in merger and acquisition activity in the analytical and life science instrument industry. Agilent Technologies and Danaher Corporation announced the two biggest deals, which also involved companies deeply involved in spectroscopy markets. Agilent Technologies announced its intention to acquire Varian, a company with significant spectroscopy capabilities, including its key nuclear magnetic resonance (NMR) business, of special interest to Agilent. Regulatory approvals have been received, but include the need to divest certain businesses including Varian's inductively coupled plasma–mass spectrometry (ICP-MS) and gas chromatography (GC)–MS-MS product lines. At $1.5 billion, this was the biggest transaction for our industry in some time. Danaher also announced a twofold transaction, which would bring into a single entity the mass spectrometry businesses of the MDS Analytical Technology Division and Life Technologies' mass spectrometry business that came with its acquisition of Applied Biosystems in 2008. Combined, this transaction is valued at $1.1 billion.

Table I: Spectroscopy product growth prospects for 2010

Interest in aftermarket products and services, including such items as consumables (especially chemicals), software updates, and accessories is very keen. As the installed base of instruments grows and the market matures, the aftermarket becomes especially important. In fact, in selected technology areas, the aftermarket is a very significant product segment that is growing faster than instrument system revenues and is often more profitable. It is also true that for some technologies, instrument systems (hardware) actually might be declining in unit sales while the aftermarket provides at least minimal growth. So it should be noted that all the revenue projections in this article include the total mix of revenue sources: instrument system sales, aftermarket, and service.

The Overall Spectroscopy Market

The spectroscopy market can be segmented into three distinct sectors: molecular spectroscopy, atomic spectroscopy, and mass spectrometry. The applications of the techniques included in each sector and their prospects differ significantly, especially within each sector. Worldwide revenues for all spectroscopy segments is estimated at about $8.5 billion for 2009, or about 23% of the entire laboratory analytical and life science instrument market.

The overall spectroscopy market is estimated to have declined 3.4% in 2009, a disappointing level of performance compared to the almost 7% increase in 2008 over 2007. SDi projects spectroscopy market growth in 2010 to exhibit renewed strength and increase at the rate of 7.2%. Such a rebound more than makes up for the decline experienced last year and puts the market at almost 4% higher than that in 2008. In addition to the positive affects of a general return to global economic growth, government stimulus programs in many countries, but especially in the U.S., China, and the EU, will give a real boost to the instrumentation industry. Likewise, various industrial markets such as metals, semiconductors, automotive production, and chemicals will be reinvigorated. In combination with continued growth from academia and government expenditures, the prospects look very good for both 2010 and 2011.

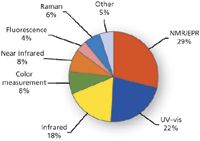

Figure 2: 2009 molecular spectroscopy market by technique.

Molecular spectroscopy techniques account for almost 40% of the spectroscopy market, although many diverse techniques are represented that address a wide range of applications in almost every industry category. Atomic spectroscopy is the second largest sector at over 33%, while MS represents 27% of spectroscopy revenues. Please note that liquid chromatography (LC) and GC front-ends to mass spectrometers, and their associated aftermarket and service revenues, are not included in this analysis.

Molecular Spectroscopy

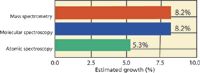

In 2009, the global molecular spectroscopy market contracted by 3.3% to about $3.4 billion, but it is expected to see a solid rebound in growth in 2010 of more than 8% growth, with similar growth to follow in 2011. The relatively high proportion of demand that comes from government and academic laboratories, as well as its association with life science applications, has helped to insulate the molecular spectroscopy market significantly from the impact of the deep recession.

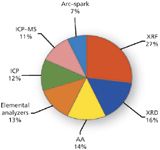

Figure 3: 2009 atomic spectroscopy market by technique.

Most molecular spectroscopy techniques experienced approximately flat growth in demand in 2009, with the major exceptions being color measurement, which saw a whopping 25% drop, and Raman, which showed better than 6% growth. The color analysis market is not significantly tied to the rest of the molecular spectroscopy market, either in terms of end-users or vendors, and currently is experiencing decreased demand of more than 30% from its peak in 2007 of around $375 million. Even with a return to growth in the high single-digits, it will be some time before the color analysis market approaches its previous high-water mark.

Raman spectroscopy was the only molecular spectroscopy technique to see significant positive growth in demand in 2009, due almost exclusively to the explosion in demand for handheld and portable instruments. Portable infrared instruments saw even stronger growth than handheld Raman, but were not nearly enough to offset a small percentage drop in the much larger overall infrared spectroscopy market. To a lesser extent, the same was true of handheld near infrared (NIR) demand in the near-infrared market. In 2010, growth in demand for Raman easily should be back in the double-digits as the technique grows into a more mature market. The more broad-based infrared and molecular spectroscopy markets will see annual growth in the 6–8% range.

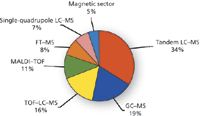

Figure 4: 2009 MS market by technique.

The NMR market, which accounts for nearly 30% of the molecular spectroscopy market, saw a slight pullback in demand in 2009 as many end-users cancelled or put on hold such big-ticket orders. However, the large installed base helped drive demand for service and aftermarket products, such as probes and cryogenic gases, which still grew slightly. Some of the held-back demand for systems in 2009 will be converted to orders in 2010, thus leading a return to double-digit annual growth, which NMR often achieves. Because of the fact that such a high proportion of NMR demand comes from academic and governmental laboratories, the stimulus spending initiatives put in place over the past year will undoubtedly have a disproportionately large impact on the NMR market.

The ellipsometry market, which is tied heavily to the semiconductor and electronics industry, has seen sliding demand since 2007. However, the technology industry, which looks to be leading other industries out of the recession, should drive a significant rebound in demand somewhat more quickly than other molecular spectroscopy techniques.

Figure 5: Spectroscopy market by product segment.

Both the UV–vis and polarimeter and refractometer markets saw very steady demand from 2008 through 2009, and should return to mid-single-digit growth in 2010. Both of these markets consist of instruments that are generally lower in cost, most of which are under $10,000. As relatively small-ticket items, they were less of a consideration to end-users who had to cut capital budgets in 2009. Demand for microvolume UV–vis, which is related primarily to the biotechnology industry, will continue to see very strong double-digit growth, more than offsetting generally flat to declining segments of the UV–vis market such as single-beam and visible-only instruments.

Fluorescence instrumentation is also tied to the life science market, but standalone instruments continue to exhibit sluggish demand. This is primarily because of microplate readers that often include a fluorescence detection mode and offer productivity improvement potential for many applications.

One very new area within molecular spectroscopy is terahertz spectroscopy, which currently represents less than $10 million in annual global demand but is poised to develop into another significant segment of the molecular spectroscopy market. Several vendors have recently introduced, or are about to introduce, new terahertz systems, which initially are being targeted at the pharmaceutical and hospital–clinical markets, although significant potential lies in other areas such as security.

Figure 6: Estimated growth by spectroscopy sector for 2010.

A very large number of suppliers are involved in the design, manufacture and sale of molecular spectroscopy instrumentation. Overall market share position, however, tends to be a function of dominance in particular product segments. Bruker is the overall leader based upon its very significant NMR–electron paramagnetic resonance (EPR) business, as well as its involvement in infrared technology. Varian is also a major NMR vendor with a leading role in UV–vis. Thermo Scientific and PerkinElmer, in the third and fourth positions, offer a wider array of molecular spectroscopy instruments, but with very strong positions in infrared and UV–vis. Foss has recently moved into fifth position as the result of increased interest in food and agricultural for which its NIR and IR instruments are in demand.

Specialty suppliers like Hach Danaher in UV–vis for water analysis and Horiba in Raman and fluorescence are key participants in their respective areas of focus. Color measurement companies such as X-Rite, formerly the number five supplier, and Datacolor have both suffered from diminished demand in the auto, packaging, textiles, and clothing sectors.

Atomic Spectroscopy

Following on a disappointing 2009, the atomic spectroscopy market is forecast to grow at 5.3% for 2010. Last year, SDi speculated that environmental applications would help to keep demand for several of the relevant atomic spectroscopy techniques stable in 2009 due to rising international interest in green technologies and environmental safety. Unfortunately, this turned out to be only partially the case. Although particular elemental analyzers and sum parameter instruments like total organic carbon (TOC) did continue to achieve growth, the workhorse environmental techniques of atomic absorbance (AA) and ICP spectroscopy experienced significant declines in 2009, as industry and environmental testing laboratories managed to achieve greater workflow with their current instrumentation and delayed replacements of older instruments.

AA and ICP are among the larger markets within atomic spectroscopy, and their decline contributed to the overall decline of 4.3% in this technology segment in 2009. Although AA and ICP will achieve positive growth for the coming year, these markets are forecast to fall short of the 2008 demand. ICP-MS, the most sensitive atomic spectroscopy technique, remained essentially flat in 2009 and should experience much better growth for 2010, aided not only by additional environmental demand, but also other important applications in pharmaceuticals, semiconductors, and electronics. The aforementioned elemental analyzers, particularly TOC and other sum parameter instruments, also should achieve better than average growth for the sector.

Inorganic elemental analyzers will not improve quite as much as TOC or the organic analyzers. Part of the reason for the difference is the metals industry, which is a healthy consumer of many specialized metals analysis instruments in the inorganic elemental analyzers category. Although global metal production has not recovered fully, producers are beginning to ease cutbacks and this should provide a moderate beneficial effect to that market, as well as the market for arc-spark optical emission spectroscopy, which is almost entirely dependent upon metals analysis. This also applies to the X-ray fluorescence (XRF) market, which has utility in metals analysis. But the XRF market has become a very diverse market, with applications ranging from metals and semiconductors, to environmental analysis of soils or paint, to the analysis of consumer products for hazardous substances.

Restrictions on Hazardous Substances (RoHS) and similar directives have helped grow the XRF market into the largest individual technique over the past few years. New regulations on lead, cadmium, and other hazardous elements in toys from China are continuing to help expand the market in the short term. Although XRF as a whole has been subject to many conflicting trends and drivers, the short-term outlook is for significant growth in 2010. X-ray diffraction (XRD), should achieve the greatest growth for 2010 at 7.4%. Quite unlike the rest of the atomic spectroscopy segment, the major driver for XRD is in life science: research on the crystallography of proteins and small molecules.

The top five vendors make up a little more than half the market. Thermo Scientific holds the leading position with 15% of the market, a position it has attained due to its participation in all of the individual technology areas, and its great strength in several individual markets. PerkinElmer, with a 10% share, competes primarily in AA, ICP, and ICP-MS, but also has elemental analyzers. The next three companies, Spectris, Rigaku, and Bruker, are involved principally in XRF and XRD. The sixth largest vendor, Varian Instruments, is being acquired by Agilent, which itself has a leading market share in the ICP-MS market. Considered together, Agilent and Varian would hold the third position in the overall market, with a total share of about 9%. More focused players dominate in some markets, such as Spectro Analytical (AMETEK), which leads the arc-spark market, and LECO, which rules both inorganic and organic elemental analysis.

Specialty-oriented suppliers such as Teledyne Leeman, with its environmental orientation for ICP and mercury analyzers, Analytik Jena in AA and inorganic elemental analyzers, and Innov-X with handheld XRF analyzers, and several others, are important contributors.

Mass Spectrometry

For the first time in many years, the overall MS market actually declined in revenues in 2009, although the 2.5% contraction in demand was fairly small compared to the broader analytical instrument market, let alone the broader economy. SDi expects MS to rebound significantly in 2010, growing by 8.2%, and reaching nearly $2.5 billion in worldwide demand. The heavy focus on science of proposed governmental stimulus spending is expected to help demand for larger ticket items such as mass spectrometers, which will drive demand through both government and academic laboratories. Significant demand was pushed back into 2010 by companies that put major capital expenditures on hold, which also supports the notion of a strong rebound.

Despite the deep global recession, vendors have continued the fairly rapid pace of technological development that has been a hallmark of the MS industry. The seemingly unabated flow of new product introductions with ever-improving performance capabilities will help maintain high single-digit growth in 2010 and beyond, with a large percentage of initial system sales representing replacements of instruments that are rapidly becoming obsolete for high-end research.

The tandem LC–MS market, which includes triple-quadrupole and ion-trap LC–MS, accounts for more than a third of the overall MS market. This market segment is expected to see growth of nearly 9% in 2010. Market share positions of the major suppliers also have shifted somewhat based upon new product introductions and especially because of the initiatives of Agilent Technologies.

While the GC–MS market was considerably affected by sharp downturns in the oil and gas and environmental industries in 2009, food safety demand helped to offset the drop, and should help continue to drive the market in 2010. Gradually rebounding oil prices and more progressive environmental regulation and enforcement will lead to mid-single-digit annual growth going forward. One bright spot in this area is the triple-quadrupole systems segment, which has grown significantly as a result of the need to obtain more detailed information on unknown compounds more easily than by using multiple instruments. Such instruments offer increased sensitivity and selectivity than has been available on traditional GC–MS instruments. Application demand and user interest has driven growth and caused other suppliers, such as Agilent Technologies, to enter this market.

The fastest growing segments of the MS market will be the time-of-flight (TOF) LC–MS market, which includes quadrupole TOF (Q-TOF) and LC–TOF, and the Fourier transform (FT)-MS market, both of which are expected to see consistent double-digit growth for the foreseeable future. These two markets generally consist of the highest performance and most expensive of all mass spectrometers, and it has seen numerous new instrument introductions that rapidly make currently installed models obsolete.

The matrix-assisted laser desorption ionization (MALDI)-TOF market has seen the pace of growth in demand fall off considerably in the last few years, although segments of the market are seeing renewed vigor because of various niche-like life science applications such as a replacement for sequencers, microbial identification, or in imaging applications. They will keep annual growth in the 4–5% range, as opposed to the relatively minimal contraction seen in 2009.

Single-quadrupole LC–MS will see a return to between 6% and 7% annual growth for the next several years. The introduction of instruments specifically designed to work better with new ultrahigh-pressure liquid chromatography (UHPLC) instruments that have proven very popular will help drive growth, as will the steady trend of high performance liquid chromatography (HPLC) users adding MS detection to their systems.

The magnetic sector market will continue to plod along with low single-digit growth, following a slight decline in 2009. This is by far the most mature of the MS markets, although very useful in specific applications. Significant new models and performance improvements are quite rare in this market, which might only occur once per decade.

There has been a high degree of industry consolidation during the last several years and now five firms account for almost 80% of the MS market. Applied Biosystems, now part of Life Technologies, is the market leader, although this business is slated to be acquired by Danaher Corporation, which also is acquiring the manufacturing portion of this business from MDS. The other major MS vendors include Thermo Scientific, Agilent Technologies, Waters, and Bruker, all of which offer a number of MS techniques. Competition among these suppliers has intensified, as has the competition between the various technologies.

Although not as broad-based, suppliers such as Shimadzu in MALDI-TOF, LECO in GC–TOF and LC–TOF, and JEOL in magnetic sector technology maintain important positions in their respective areas of emphasis.

Spectroscopy's Diversity Limits the Effects of the "Great Recession"

There is no question but that the diversity and scope of spectroscopy contributes to its continued importance and presence in laboratories around the world. But this diversity also has minimized its vulnerability to sectors of the economy most affected during economic downturns as the various techniques address applications in areas somewhat separate from the overall economy. For example, spectroscopy's utility has even moved beyond the laboratory due to the advent of innovative handheld instruments for analytical challenges that cannot be addressed easily in a laboratory. This was most evident in handheld XRF instruments that have been used to reduce lead contamination of waste disposal sites and nearby groundwater and to detect the presence of lead in toys, and most recently, to comply with new regulations in the U.S. relating to lead in children's clothing. In addition, a host of new handheld instruments based upon IR, NIR, UV–vis, and Raman technologies are sweeping the market for security and defense, drug identification, food inspection, and environmental monitoring.

Atomic spectroscopy techniques are associated most closely with environmental applications and the analysis of metals and minerals. The global economic slowdown has impacted this portion of the spectroscopy market the most, but it has not been a knockout punch. Water quality concerns still drive demand for ICP-MS and TOC and provide some support to the more mature AA and ICP markets. Likewise, XRD continues to benefit from its indispensable service in drug development. And while the metals and semiconductor industries are not back to full speed, arc-spark and XRF instrumentation is beginning to show signs of improvement.

So while elemental analysis is rebounding nicely, molecular analysis techniques are expected to see exceptional growth in 2010. Both molecular spectroscopy and MS vendors alike will enjoy this welcome improvement in the market. Drug development, cell analysis, food testing, pesticide analysis, and so forth all depend upon molecular analysis technologies, and the demand today is indeed a good counterweight to the less exciting prospects for atomic spectroscopy. In addition, governmental stimulus programs around the globe especially favor instruments in these segments, particularly high-performance MS and NMR instruments.

It is likely that all major geographic regions will show improvement in 2010, with China and India leading the way. Actually, those countries saw little of the negative affects of the recession in 2009, having only slowed a bit. Most encouraging is the notion that the U.S. and Canada, still the largest regional market, will experience significant improvement. Europe and Latin America will do better in 2010, but still will show the effects of various country-specific structural problems.

Although the economic environment of late 2008 and most of 2009 is not something we would like to see again any time soon, all indications are that business is improving across the board. We expect to see a large number of exciting new instrument innovations introduced in the next 12–18 months, which also will contribute a general enthusiasm in the scientific marketplace.

Lawrence S. Schmid is President and Chief Executive Officer of Strategic Directions International, Inc. For more information on Instrument Business Outlook or other instrumentation research, contact Strategic Directions International, Inc., 6242 Westchester Parkway, Suite 100, Los Angeles, CA 90045, (310) 641-4982, fax; (310) 641-8851, e-mail: sdi@strategic-directions.com.

New Study Reveals Insights into Phenol’s Behavior in Ice

April 16th 2025A new study published in Spectrochimica Acta Part A by Dominik Heger and colleagues at Masaryk University reveals that phenol's photophysical properties change significantly when frozen, potentially enabling its breakdown by sunlight in icy environments.